Prajna Capital |

- Standard Chartered Bank

- Understanding Notice Section 143(1)

- Edelweiss Debt and Corporate Opportunities Fund

| Posted: 16 Oct 2015 05:08 AM PDT Standard Chartered BankThe Standard Chartered Group was formed in 1969 through a merger of two banks: The Standard Bank of British South Africa founded in 1863, and the Chartered Bank of India, Australia and China, founded in 1853.

Standard Chartered is listed on both the London Stock Exchange and the Hong Kong Stock Exchange and is consistently ranked in the top 25 among FTSE-100 companies by market capitalisation.

Standard Chartered has a history of over 150 years in banking and operates in many of the world's fastest-growing markets with an extensive global network of over 1,400 branches in over 50 countries in the Asia Pacific Region, South Asia, the Middle East, Africa, the United Kingdom and America.

Standard Chartered derives over 90 per cent of profits from Asia, Africa and the Middle East, serving both consumer and wholesale banking customers worldwide.

From the early 90s, Standard Chartered focused on consumer, corporate, and institutional banking and on the provision of treasury services. In the new millennium Standard Chartered acquired Grindlays Bank from the ANZ Group and the Chase Consumer Banking operations in Hong Kong in 2000. Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. IDFC Tax Advantage (ELSS) Fund 4. ICICI Prudential Long Term Equity Fund 5. Religare Tax Plan 6. Franklin India TaxShield 7. DSP BlackRock Tax Saver Fund 8. Birla Sun Life Tax Relief 96 9. Reliance Tax Saver (ELSS) Fund 10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 |

| Understanding Notice Section 143(1) Posted: 16 Oct 2015 04:33 AM PDT You paid all your tax dues and filed your return in time; yet you have received a notice under section 143(1) in your mailbox? Don't worry, let's help you understand this notice sent under section 143(1) by the income tax department as well as explain what suitable action can be taken to address it. Review a few things to make sure this document pertains to your return

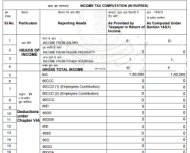

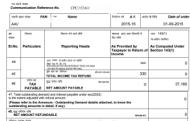

Understanding Notice under section 143(1) Notice or intimation under section 143(1) is a computer generated record. The income tax department validates each tax return with its own record and this notice usually only points out apparent mistakes found out by the system. This intimation has two columns 'As provided by taxpayer in the Return of Income' and 'As computed under section 143(1)' where the amounts are compared for these – income under various heads and deductions, TDS and self tax payments. You can run through each of these amounts and find out where the discrepancy is. It could be that a certain TDS has been disallowed or there is a mismatch in self-assessment tax payments, a rounding off error. A final tax due or refundable is computed. When there is no mismatch Its likely that all of the fields are matching and there is no tax due or refundable – in such a case you can safely assume the intimation to be an acknowledgement of your tax return. No further action is required from your side. When there is a final tax due and you agree with it You need to make payment of this tax due to the income tax department. Read how a payment can be made – here. Once you make a payment of the tax due, no further action is required from your end. Where there is a final tax due and you do not agree with it One of the situations where this arises is when a certain TDS has been disallowed. Or a self-assessment tax payment has not been considered. If you do not agree with the final calculations done by the department, you need to file a rectification under section 154(1). This can be done by – Log on to e-Filing application https://incometaxindiaefiling.gov.in/ and GO TO –> My Account –> Rectification request. You can also reach out to your assessing officer and submit an application in writing. Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1.ICICI Prudential Tax Plan 2.Axis Tax Saver Fund 3.IDFC Tax Advantage (ELSS) Fund 4.DSP BlackRock Tax Saver Fund 5.Religare Tax Plan 6.Franklin India TaxShield 7.Canara Robeco Equity Tax Saver 8.BNP Paribas Long Term Equity Fund 9.Reliance Tax Saver (ELSS) Fund 10.HDFC TaxSaver

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online - For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300

|

| Edelweiss Debt and Corporate Opportunities Fund Posted: 16 Oct 2015 03:36 AM PDT Edelweiss Debt and Corporate Opportunities Fund - Invest OnlineEdelweiss Mutual Fund has made the following changes in the fundamental attributes of Edelweiss Debt and Corporate Opportunities Fund with effect from October 30, 2015.Name of Scheme:The revised name of the scheme is Edelweiss Equity Savings Advantage Fund. Type of Scheme:The type of scheme has been changed from open-ended Hybrid scheme to open-ended equity scheme. Investment Objective: The investment objective of the scheme is to generate income by investing in low volatility absolute return strategies that take advantage of opportunities in the cash and the derivative segments of the equity markets including the arbitrage opportunities available within the derivative segment and by investing the balance in debt and money market instruments. Asset Allocation: The asset allocation pattern has been changed to 65-90 per cent allocation in equity and equity related securities including Derivatives and 10-35 per cent in debt and money market instruments. Benchmark: 75% Crisil Liquid Fund Index and 25% CNX Nifty Index. Existing investors, who do not wish to continue with the scheme, in view of the proposed change can exit from the scheme between September 30, 2015 and October 29, 2015. Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1.ICICI Prudential Tax Plan 2.Reliance Tax Saver (ELSS) Fund 3.HDFC TaxSaver 4.DSP BlackRock Tax Saver Fund 5.Religare Tax Plan 6.Franklin India TaxShield 7.Canara Robeco Equity Tax Saver 8.IDFC Tax Advantage (ELSS) Fund 9.Axis Tax Saver Fund 10.BNP Paribas Long Term Equity Fund

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online - For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 --------------------------------------------- Invest Mutual Funds Online Download Mutual Fund Application Forms from all AMCs |

| You are subscribed to email updates from Prajna Capital - An Investment Guide. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment