Prajna Capital |

- Systematic Withdrawal Plan (SWP)

- ICICI Pru Dynamic Plan

- Gold investment - Gold ETFs can be better option than Gold Bonds

| Systematic Withdrawal Plan (SWP) Posted: 12 Oct 2015 04:54 AM PDT Systematic Withdrawal Plan (SWP) - Invest Online Mutual fund investors can withdraw their mutual fund investments systematically over a period of time by setting up a systematic withdrawal plan with the fund house. The funds thus withdrawn periodically are credited to the investor's bank account. These can be used to meet monthly household expenses or may be used to reinvest in some other investment product. Form To enroll, the investor has to to fill up a SWP form. This can be downloaded from the fund website. Investors are required to use separate forms for different schemes, plans and options. Types of SWP There are two variants, fixed amount and appreciation withdrawal. In the first, a fixed sum is redeemed on the SWP date.In the other, any appreciation that has happened in the scheme as on the SWP date is redeemed from fund periodically. Dates and frequency The investor has to choose a particular date in the month on which he would like the SWP transaction to take place. The frequency of SWP needs to be mentioned. Also, the SWP start date and end date must be mentioned in the form. Bank details Proceeds from SWP are credited to the default bank account registered with the fund house. However, if the investor wants the proceeds to be credited to another account, the same needs to be mentioned. Process The form is required to be submitted at the official points of acceptance of transactions. The SWP start date should be about a month away from the date of submission of form so as to allow processing of the request or as may be mentioned by the fund house. In case of joint holders, all holders are required to sign the form.The fund house mentions the list of schemes that are eligible for SWP. It's a good idea to check with the fund whether the facility is offered at the time of investing.If the investor is using an online platform for mutual fund investments, he can also set up SWP online. Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1.ICICI Prudential Tax Plan 2.Reliance Tax Saver (ELSS) Fund 3.HDFC TaxSaver 4.DSP BlackRock Tax Saver Fund 5.Religare Tax Plan 6.Franklin India TaxShield 7.Canara Robeco Equity Tax Saver 8.IDFC Tax Advantage (ELSS) Fund 9.Axis Tax Saver Fund 10.BNP Paribas Long Term Equity Fund

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online - For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 --------------------------------------------- Invest Mutual Funds Online Download Mutual Fund Application Forms from all AMCs | ||

| Posted: 12 Oct 2015 02:10 AM PDT ICICI Pru Dynamic Plan - Invest Online If you are looking for a fund that would defend your portfolio well, ICICI Pru Dynamic will fit your requirement. The fund managed a good 27 per cent compounded annual return since its launch in October 2002, way ahead of the 15-percent return of its benchmark S&P Nifty. This outperformance is noteworthy as the fund has a strategy of taking active cash calls by shifting a good chunk of its assets to debt when equity valuations seem high.

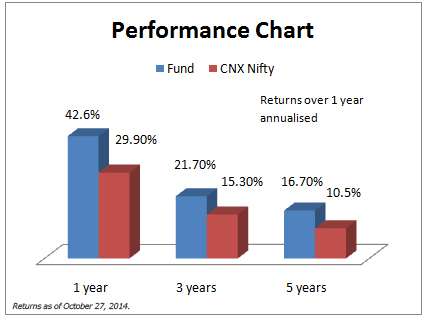

The Fund ICICI Pru Dynamic seeks to invest in equities, taking into account the price to book value of the market. It invests across market capitalisation (large, mid and small) based on the attractiveness of stock valuation across segments. When valuations in the mid-cap space are attractive, the fund manager seeks to increase the fund's exposure to such stocks, while ensuring that such a segment does not constitute a majority of the exposure. Although an equity fund, ICICI Pru Dynamic's mandate allows it to move even 100 per cent of its assets into debt or cash, or hedge the portfolio using derivatives. However, normally, the cash levels are mostly maintained within the range of 0-35 per cent and rarely goes above 35 per cent. The cash calls are taken based on stock market valuations. A higher price to book value than the fair value range triggers an increase in cash levels and vice versa. Suitability If you look at one-year performance toppers, you will not find ICICI Pru Dynamic. This is not a fund for return chasers. If you want to participate in the equity market for the long term, but with relatively lower risks (especially risks associated with market valuations seeming too high), you can consider investing in this fund. The fund seeks to follow a common sense approach, by increasing the equity exposure (buy more) at low market levels, and reducing the equity exposure (sell some) at higher market levels. But this approach would mean reducing equity exposure when other equity funds are fully invested, or going underweight on a sector that has premium valuations when peers hold on to it. This might also mean losing out on some short-term return opportunities. This fund can work for you in combination with other equity funds as it can provide market-beating returns, while at the same time, providing some hedge in a bear market. While we usually recommend the Systematic Investment Plan (SIP) route in equity funds, it may not be too risky to take small lump sum exposure to ICICI Pru Dynamic as it tries to time the market for you based on valuations. When markets are expensive, the fund will likely move to cash, ensuring that you do not get hurt even if you time your entry in the market peak. Investors with a long-term perspective can add ICICI Pru Dynamic along with other equity funds as a part of their core portfolio. Performance ICICI Pru Dynamic has beaten its benchmark over five and 10-year time frames, with a compounded annual return of 16 per cent and 24 per cent respectively. Its benchmark CNX Nifty delivered 10 per cent and 16 per cent return over the same periods.

On a rolling three-year return basis (in the last five years), the fund beat its benchmark 96 per cent of the times. While the fund's performance might seem exceptional, its rolling returns also bring out periods of underperformance (with peers), especially in a rallying market. It contains the downside well in falling markets. ICICI Pru Dynamic's returns deviate far lesser from its average compared with peers. That means its returns swing less. For a defensive fund, these returns are justified for the risk it takes. This is also reflected in its risk adjusted returns measure (measured by Sharpe ratio), which is also higher compared with the peer group. Portfolio

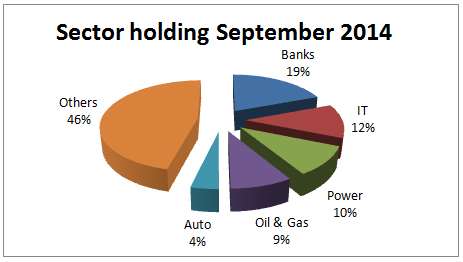

As of September, the fund was invested in equities only to the extent of 67 per cent, net of the Nifty Futures it held. It currently holds about 55 stocks. Over 70 per cent of the stocks are from the large-cap segment. Top 10 stocks accounts for 47 per cent of the portfolio. Banking, power and Information Technology (IT) are the top three sector holdings. The fund's sector exposure suggests that it may have been uncomfortable with valuations in certain sectors. During September 2014, it remained relatively overweight on power, telecom and transportation sectors. It remained relatively underweight on banks and finance, auto, consumer non-durables and retailing. Power Grid Corporation of India, HDFC Bank, ICICI Bank and SBI were its top holdings as of September 2014. The fund is managed by Sankaran Naren and Mittul Kalawadia. Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1.ICICI Prudential Tax Plan 2.Reliance Tax Saver (ELSS) Fund 3.HDFC TaxSaver 4.DSP BlackRock Tax Saver Fund 5.Religare Tax Plan 6.Franklin India TaxShield 7.Canara Robeco Equity Tax Saver 8.IDFC Tax Advantage (ELSS) Fund 9.Axis Tax Saver Fund 10.BNP Paribas Long Term Equity Fund

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online - For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 --------------------------------------------- Invest Mutual Funds Online Download Mutual Fund Application Forms from all AMCs | ||

| Gold investment - Gold ETFs can be better option than Gold Bonds Posted: 12 Oct 2015 01:16 AM PDT

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1.ICICI Prudential Tax Plan 2.Reliance Tax Saver (ELSS) Fund 3.HDFC TaxSaver 4.DSP BlackRock Tax Saver Fund 5.Religare Tax Plan 6.Franklin India TaxShield 7.Canara Robeco Equity Tax Saver 8.IDFC Tax Advantage (ELSS) Fund 9.Axis Tax Saver Fund 10.BNP Paribas Long Term Equity Fund

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online - For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 --------------------------------------------- Invest Mutual Funds Online Download Mutual Fund Application Forms from all AMCs |

| You are subscribed to email updates from Prajna Capital - An Investment Guide. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment