Prajna Capital |

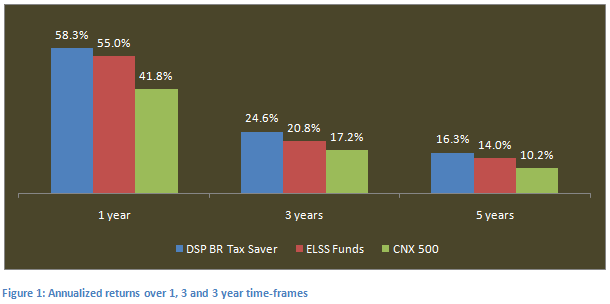

| DSP BlackRock Tax Saver Fund - A ELSS Fund for 2016 Posted: 29 Jan 2016 04:03 AM PST DSP BlackRock Tax Saver Fund Invest Online ELSS funds offer triple benefits of tax savings, capital appreciation and tax free returns to the investor. The DSP BlackRock Tax Saver fund, one of the top ELSS funds, has outperformed the tax saving funds category by delivering two times returns in the last three years. The fund has consistently given superior returns relative to the ELSS funds category and the broader market, over the different time periods. The chart below shows the annualized trailing returns of the DSP BlackRock Tax Saver fund growth option, regular plan, over the last 1, 3 and 5 year time periods, compared to the ELSS funds category and the CNX 500 index. NAVs as on June September 19 2014.

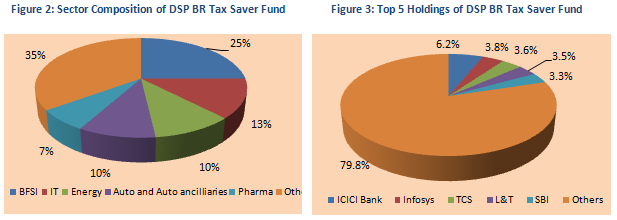

Fund OverviewThe DSP BlackRock Tax Saver Fund was launched in November 2006 and has performed very well relative to the market since its inception. The fund has Portfolio CompositionThe fund has a large cap, growth oriented focus. The fund manager has a bottoms-up portfolio construction approach. The fund manager tries to identify stocks with high growth potential for this portfolio. He also invests in stocks that are trading at attractive valuations. The portfolio is overweight on cyclical sectors like BFSI, Oil & Gas, Automobile & Auto Ancillaries etc. To balance its exposure to cyclical, the portfolio also has allocations to defensive sectors, with IT and Pharmaceuticals comprising nearly 15% of the portfolio holdings, as on May 31 2014. With cyclical sectors poised to do well with the revival in economic growth and capex cycle, the DSP BlackRock Tax Saver fund has the potential to deliver good returns over the short to medium term. The portfolio is very well diversified in terms of company concentration. The top 5 companies in the fund portfolio, ICICI Bank, Infosys, TCS, Larsen & Toubro, and SBI account for only 20% of the portfolio value. Even the top 10 companies in the fund's portfolio account for less than 34% of the portfolio holdings.

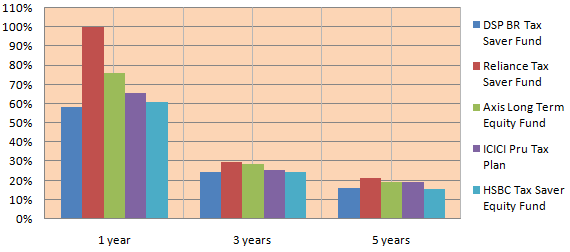

Comparison with Peer SetsDSP BlackRock Tax Saver fund is one the top performing ELSS funds. The chart below shows the comparison of 1 year, 3 years and 5 years annualized returns of the DSP BlackRock Tax Saver with other top performing ELSS funds.

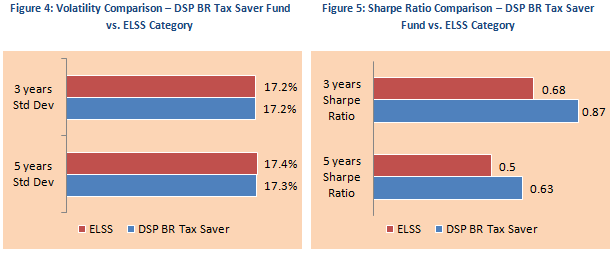

Risk and ReturnThe DSP BlackRock Tax Saver fund has consistently outperformed the ELSS funds category and the CNX 500 over the last 3 years. The fund gave a trailing return of over 58% and 24% in the last one and three years respectively. In terms of risk measures, the annualized standard deviation of monthly returns of the DSP BlackRock Tax Saver fund is in line with the ELSS funds category. However, on a risk adjusted returns basis, as measured by Sharpe Ratio, the DSP BlackRock Tax Saver fund has outperformed the ELSS funds category. Sharpe ratio is defined as the ratio of excess return (i.e. difference of return of the fund and risk free return from Government securities) and annualized standard deviation of returns. Higher the Sharpe ratio better is the risk adjusted performance of the fund. See charts below for comparison of volatilities and Sharpe ratios of the DSP BlackRock Tax Saver and the ELSS Funds Category

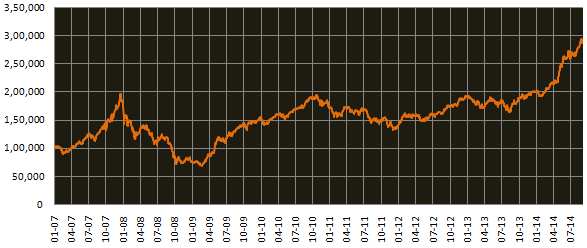

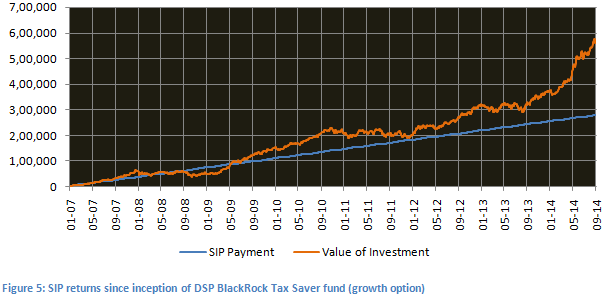

The chart below shows the returns since inception of

The chart above shows that a monthly SIP of Conclusion The DSP BlackRock tax saver fund has delivered over 7 years of strong performance. This fund is suitable for 80C investors with a long time horizon. Investors can consider investing in the scheme through the systematic investment plan (SIP) or lump sum route. Investors should consult with Prajna Capital, if DSP BlackRock Tax Saver fund is suitable for their tax planning needs. ----------------------------------------------- Invest Rs 1,50,000 and Save Tax under Section 80C. Get Great Returns by Investing in Best Performing ELSS Mutual Funds Top 10 Tax Saving Mutual Funds to invest in India for 2016Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. Franklin India TaxShield 4. ICICI Prudential Long Term Equity Fund 5. IDFC Tax Advantage (ELSS) Fund 6. Birla Sun Life Tax Relief 96 7. DSP BlackRock Tax Saver Fund 8. Reliance Tax Saver (ELSS) Fund 9. Religare Tax Plan 10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 -----------------------------------------------

|

| Posted: 29 Jan 2016 03:37 AM PST Invest Principal Bank CD Fund Online Principal Bank CD Fund is positioned to capitalize the above opportunity as the fund aims to invest in Bank CD's of upto 1 year and lock-in funds at a relatively higher yields. This will enable the portfolio to benefit from the high accruals available in these papers in this quarter.

Investment Strategy: ü Invest primarily in private sector bank CD's ü Invest up to 20% in 1 year NCD's issued by Housing finance companies or companies which have recently received small banking license from RBI ü Higher accrual in NCD's (approx. 50 to 200bps) to provide a yield pick up to the overall portfolio ----------------------------------------------- Invest Rs 1,50,000 and Save Tax under Section 80C. Get Great Returns by Investing in Best Performing ELSS Mutual Funds Top 10 Tax Saving Mutual Funds to invest in India for 2016Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. Franklin India TaxShield 4. ICICI Prudential Long Term Equity Fund 5. IDFC Tax Advantage (ELSS) Fund 6. Birla Sun Life Tax Relief 96 7. DSP BlackRock Tax Saver Fund 8. Reliance Tax Saver (ELSS) Fund 9. Religare Tax Plan 10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 -----------------------------------------------

|

| Posted: 29 Jan 2016 12:17 AM PST UTI Mastershare Invest Online Like many large-cap-oriented funds, old warhorse UTI Mastershare too has stumbled over the past year, losing 3 per cent. Blame this on two factors. In the volatile market since January this year, several large-cap stocks, particularly those in the commodity space, have ended up on the losing side. In contrast, many mid-cap stocks have held their heads above water. So, the S&P BSE Sensex is down 10 per cent, the S&P BSE 100 has slipped 8 per cent while the S&P BSE Mid-cap index is still up 4 per cent. Relative to peers, the share of large-caps in UTI Mastershare's portfolio is on the higher side — across market cycles, they have formed 80 per cent or more of the fund's portfolio. Currently, large-cap stocks (market capitalisation of ₹10,000 crore and more) make up nearly 85 per cent of the fund's portfolio. The short-term picture may not look pretty, but UTI Mastershare remains a good choice for conservative investors and those who seek regular dividends. One, the 29-year old fund, a veteran of many market cycles, has delivered good returns in longer periods — about 14 per cent annualised over three years, 9 per cent over five years and 12.5 per cent over 10 years. These are not top-of-the-chart, and there are peers who have done better. That said, when the market takes deep cuts like in 2009, 2011 and 2013, the fund's bias towards large-caps helps it contain the downside very effectively. Being overweight on large-caps may pay off at the current iffy market juncture, too. If the pain in the market worsens, large-caps may not suffer as much as mid- and small-caps. And a revival may see large-caps rally faster to make up for lost ground. Good dividend recordUTI Mastershare ranks middle-of-the-road in its category, but the fund beats its benchmark BSE 100 fairly consistently, doing better during both market upsides and downsides. On an annual rolling return basis, the fund has outperformed the benchmark nearly three-fourths of the time over the past five years, and almost always in the past year. Its one-, three- and five-year returns are higher than the benchmark's by 3-5 percentage points. UTI Mastershare has an enviable record of declaring dividends without a break, even in tough years. While the fund follows a growth-oriented strategy, a fairly diversified portfolio consisting of more than 50 stocks reduces risk. Good stock selection and well-timed moves have helped. Picks, such as MRF, Shree Cement, Asian Paints and Maruti Suzuki have tripled to quintupled over the past five years. Over the last year, the fund's timely moves included adding up on Infosys, which is reviving well, and cutting down on Vedanta, which is getting hit by the commodity downturn. The few mid-caps in the portfolio are quality names, such as Indraprastha Gas and SKF India. The fund remains invested mostly in equities (95 per cent and more of the portfolio). A mix of cyclical (banks and autos) and defensive (software and pharma) sectors form the top holdings. ----------------------------------------------- Invest Rs 1,50,000 and Save Tax under Section 80C. Get Great Returns by Investing in Best Performing ELSS Mutual Funds Top 10 Tax Saving Mutual Funds to invest in India for 2016Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. Franklin India TaxShield 4. ICICI Prudential Long Term Equity Fund 5. IDFC Tax Advantage (ELSS) Fund 6. Birla Sun Life Tax Relief 96 7. DSP BlackRock Tax Saver Fund 8. Reliance Tax Saver (ELSS) Fund 9. Religare Tax Plan 10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 ----------------------------------------------- |

| You are subscribed to email updates from Prajna Capital - An Investment Guide. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment