Prajna Capital |

| Posted: 24 Jan 2016 11:52 PM PST The complete guide to Employee Pension Scheme (EPS) 1995When I wrote a post about recent changes in the Employee Provident Fund (EPF), I received so many queries related to Employee Pension Scheme because there is a huge misconception among employees about EPS. Hence, let me write a post on this in detail.

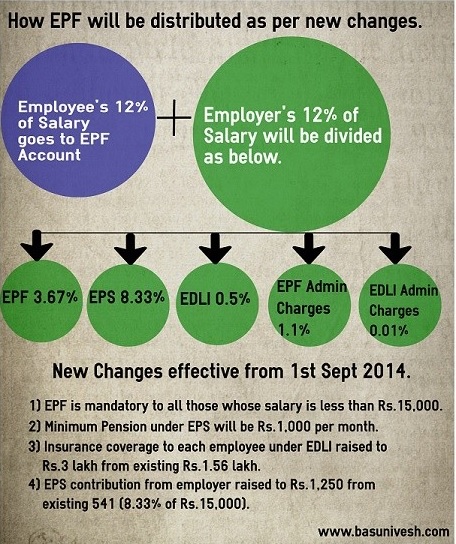

In the below image, I have tried to explain how your's and employer's EPF contribution is distributed. Many of EPF members at the first instance do not know that they have a pension scheme and for which their employer is contributing.

You will notice that the major portion of your employer contribution will go towards the Employee Pension Scheme (EPS). However, the majority of employees are ignorant about this. Few features of these schemes are-

What is an eligible service for EPS? As I said above, for calculation purpose, if your service is more than or equal to 6 months, then it will be rounded to next year. If it is less than 6 months, then such fraction of service period is not considered for calculation. For example, suppose you worked for 21 yrs and 7 months. In this case, your service is considered as 22 years. However, if your service is 21 yrs and 2 months, then service will be considered as 21 yrs only. What is pensionable service for EPS? The pensionable service is determined by the number of years your employer contributed on behalf of you. If your employer failed to deposit the amount then such months are not considered for calculation of service. Also, in case if an employee completed 58 yrs of age and completed 20 yrs of service or more, his pensionable service will be increased by 2 years for calculation purpose. What is a pensionable salary for EPS? It is the last 12 months average salary during contribution period preceding the date of exit from the membership of EPS. In case employee did not receive full payment during that last 12 months, the average of last 12 months full pay drawn by him during the period for which contribution to the EPS was recovered, will be considered for EPS calculation. In case of such last 12 months, employee hasn't contributed to EPS, including cases like where the employee has drawn a salary as part of a month, the total salary during the 12 month span will be divided by the actual number of days for which salary has been drawn. The amount so derived will be multiplied by 30 to arrive at an average monthly salary. When employees get the pension? a) Superannuation-To avail such pension, you must complete 10 yrs of service and your age must be 58 yrs or above. An employee can continue his job while receiving his monthly pension. However, he cannot be a member of EPS and hence no more fresh contribution to EPS. b) Early Pension-To avail such pension, you must complete 10 years of service and age between 50 yrs to 58 yrs. To avail such early pension, an employee must not be working. c) Death of an employee-Employee is eligible for EPS if death occurs as below.

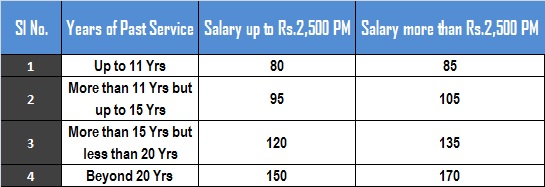

In both the cases also employee family eligible for a pension. In case of dead employee having a family, a pension is payable to the spouse and two children below 25 years of age. When a child reaches 25 years of age, the third child below 25 yrs of age will be given a pension and so on. If the child is disabled, he may get a pension until his death. Only 2 children will receive a pension at a time. In case of an employee not having a family, the pension is payable to single nominated person. If not nominated and having a dependent parent, the pension is payable first to Father and then on father's death to Mother. d) Permanently and totally disabled-If an employee is unfit to do his job due to accidental permanent and total disability during a job, then also he is eligible for the pension. How to calculate the Employee Pension Scheme pension? There are two methods based on the service you joined. One is for those who joined before 15th November 1995 and another for those who joined after this date. 1) Employees who joined before 15th November 1995- The pension is calculated separately for Past Service & Pensionable Service a) Procedure for Calculation of Past Service Pension

b) Procedure for calculation of Pensionable Service Pension–

(Average Salary X Service)/70

c) Procedure for the calculation of Total Pension-Add the Past Service Pension and the Formula Pension.

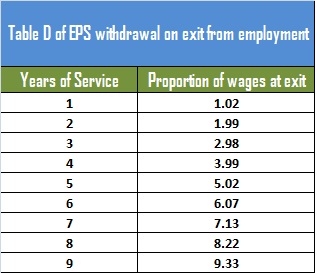

2) Employees who joined after 15th November 1995– You can directly calculate by inserting the values in the formula as given below. (Average Salary X Service)/70 You can find the wonderful, detailed calculation of this with an example at HERE or at HERE. How to apply for the pension? Once you complete the service of 10 years, then you get the scheme certificate. This scheme certificate can be used to claim your pension either from 58/50 Yrs. The employee has to include all his past services to arrive at such 10 yrs of service and apply for pension once he attains the age of 58/50. He needs to fill the Form 10D and get attested by that bank manager with photo and other required documents. Submit the form to concerned EPFO. Whether one can withdraw the EPS amount before 10 years also? Yes, you can withdraw the contributed EPS amount along with your EPF balance. But the condition is you must not have completed 10 Yrs of service. When you withdraw EPF, then you receive EMPLOYEE+EMPLOYER EPF contribution+Interest earned on this EPF. Along with that, some % of EPS contribution also be paid. This % is determined by Table D of EPS, which is given below. Hence, whatever may be your contribution to EPS, you will get only some % of this based on the number of services and salary.

This is calculated as below. Wages as on the date of exit X Corresponding Table 'D' factor. Here wages means Basic Salary+DA for EPS at the time of withdrawal. Therefore, suppose your salary is Rs.15,000 at the time of withdrawing and you completed 7 years, then you receive the EPS of Rs.1,06,950 (Rs.15,000*7.13). This is the amount you get, irrespective of your actual contribution to EPS. You have to submit the Form 10C along with other forms of EPF withdrawal to your HR. Note-I found that still EPFO not updated the manual as per the new changes. Hence, I am unable to find the corresponding values for calculation. Whenever it is updated then I do changes here also. ----------------------------------------------- Invest Rs 1,50,000 and Save Tax under Section 80C. Get Great Returns by Investing in Best Performing ELSS Mutual Funds Top 10 Tax Saving Mutual Funds to invest in India for 2016Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. Franklin India TaxShield 4. ICICI Prudential Long Term Equity Fund 5. IDFC Tax Advantage (ELSS) Fund 6. Birla Sun Life Tax Relief 96 7. DSP BlackRock Tax Saver Fund 8. Reliance Tax Saver (ELSS) Fund 9. Religare Tax Plan 10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 ----------------------------------------------- |

| Posted: 24 Jan 2016 09:03 PM PST IDFC Premier Equity Invest Online The exit of IDFC Premier Equity's fund manager, Kenneth Andrade, is not a set back as the new fund manager has co-managed the scheme since its inception.  ----------------------------------------------- Invest Rs 1,50,000 and Save Tax under Section 80C. Get Great Returns by Investing in Best Performing ELSS Mutual Funds Top 10 Tax Saving Mutual Funds to invest in India for 2016Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. Franklin India TaxShield 4. ICICI Prudential Long Term Equity Fund 5. IDFC Tax Advantage (ELSS) Fund 6. Birla Sun Life Tax Relief 96 7. DSP BlackRock Tax Saver Fund 8. Reliance Tax Saver (ELSS) Fund 9. Religare Tax Plan 10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 ----------------------------------------------- |

| Top 5 Best ELSS Mutual Funds to invest in 2016 Posted: 24 Jan 2016 06:39 AM PST In this post, I thought to list the Top 5 Best ELSS or Tax Saving Mutual Funds to invest in 2016. Because ELSS or Tax Saving Mutual Funds are main hunt of salaried. What is the tax benefit of investing in ELSS or Tax Saving Mutual Funds? Many of you who searching for ELSS or Tax Saving Mutual Fund might know the taxation of these products. To simplify, whatever you invest in ELSS or Tax Saving Mutual Funds, will be eligible for deduction under Sec.80C of IT Act. These funds will come with a lock-in of 3 years. However, do remember that if you invested say Rs.1, 00,000 in October, 2015, then you can withdraw it ONLY in October, 2018. Also, the important mistake individuals who invest in ELSS or Tax Saving Funds commit is, they start investing through SIP and consider the first SIP date as investment date and maturity will be after 3 years from 1st SIP. However, do remember that each SIP is considered as fresh investment. Hence, each monthly SIP must complete 3 years. Therefore, if starts monthly SIP in October, 2015 then this will be free to withdraw in October, 2018. The second month SIP i.e. November, 2015 SIP will be eligible to withdraw in November, 2018 and so on. As these funds are equity oriented mutual funds, the returns from such funds are totally tax-free. So people throng to such products. Because it gives a tax benefit while investing, shortest lock-in (only 3 years) product available among tax saving instruments and after 3 years the return is tax-free. In addition, being locked-in product, the commission is also high in such products. Therefore, definitely advisers push to SAVE TAX. However, sadly neither advisers nor investors completely forget the basic principle of equity INVESTMENT i.e. equity investment is meant for the LONG TERM. Finally, after 3 years, if investors have some positive return, then they cheer up, otherwise blame it on EQUITY. Recently almost all mutual fund companies renamed these ELSS or Tax Saving Mutual Funds from their earlier name as "Tax Saving" to "Long Term Equity". For example, HDFC Tax Saver Fund now changed its name to "HDFC Long Term Advantage Fund". This is to make sure that at least by name investors can feel that such funds are meant for the LONG TERM. How I shortlisted the funds? First, I screened the top 15 funds in each category based on their returns to benchmark since inception. Those among top 15 and with consistency score of 100% are below-mentioned funds.

It is hard to choose the BEST among these. However, I finally arrived based on the risk-return criteria. Below is the list of "Top 5 Best ELSS or Tax Saving Mutual Funds to invest in 2016". To arrive at the final decision, I checked the funds for below-mentioned tests and if the fund cleared all these tests and given me around a minimum of 80% score since inception, will be added to my list.

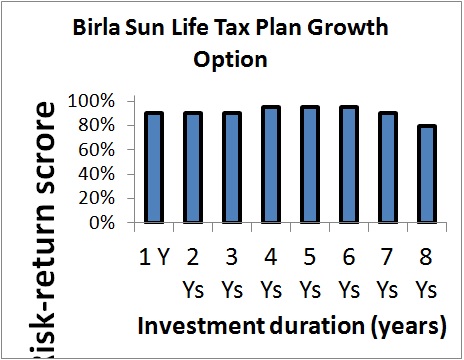

1) Axis Long Term Equity Fund-This is the fund which is catching intention of many investors. I noticed that few invested in this fund because it has provided good returns since 5 years. 2) Birla Sunlife Tax Plan-The fund is in the market since 1999. Below is the result of its consistency and reason for why I selected this fund.

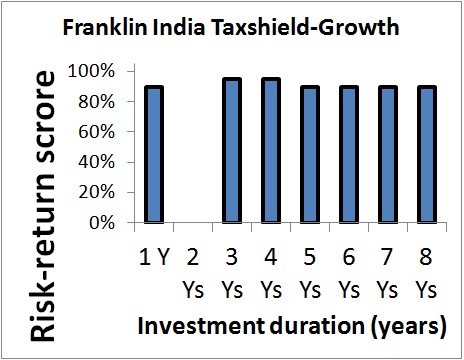

You notice the consistency of fund since 8 years and it is the eye-catching among many. 3) Franklin India Tax Shield-This is one my favorite fund, which is in top since its launch in 1999 and below is the result of the risk-return analyzer.

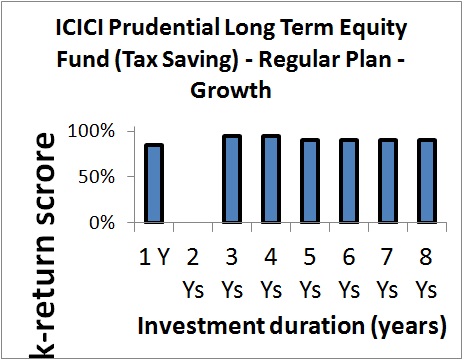

4) ICICI Prudential Long Term Equity Fund-This is the one more fund, which I suggested last year, along with Franklin India Taxshield Fund and I again recommend this fund.

5) DSP BlackRock Tax Saver Fund-This is the fund which is in the market since 2007 and consistently performed well. Hence, I included this fund in my list.

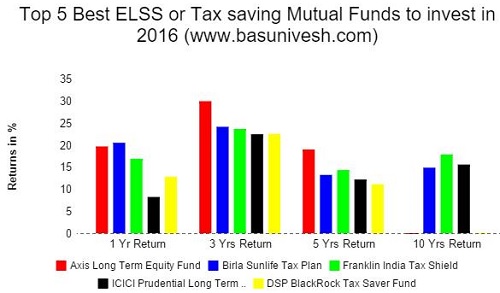

How these funds performed in case of returns?

You noticed that only 3 funds from above selection are more than 10 years old funds. Hence, I stress to consider those funds as a priority. Hope this information will be useful in selecting the Best ELSS or Tax Saving Mutual Funds to invest in India in 2016. ----------------------------------------------- Invest Rs 1,50,000 and Save Tax under Section 80C. Get Great Returns by Investing in Best Performing ELSS Mutual Funds Top 10 Tax Saving Mutual Funds to invest in India for 2016Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. Franklin India TaxShield 4. ICICI Prudential Long Term Equity Fund 5. IDFC Tax Advantage (ELSS) Fund 6. Birla Sun Life Tax Relief 96 7. DSP BlackRock Tax Saver Fund 8. Reliance Tax Saver (ELSS) Fund 9. Religare Tax Plan 10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 ----------------------------------------------- |

| You are subscribed to email updates from Prajna Capital - An Investment Guide. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment