Prajna Capital |

- ICICI Prudential Dynamic Plan Review

- Best Car Insurance Companies in India for 2016

- Invest in ELSS Mutual Funds upto 1.5 Lacs to Save Tax

| ICICI Prudential Dynamic Plan Review Posted: 24 Jan 2016 05:42 AM PST ICICI Prudential Dynamic Plan Invest Online

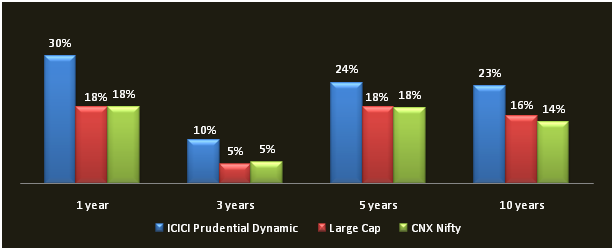

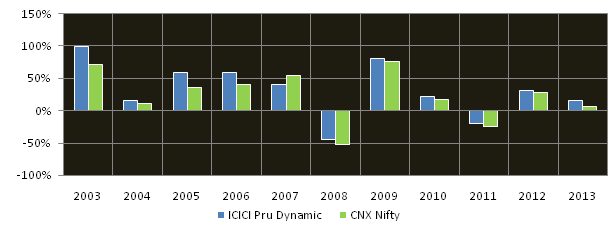

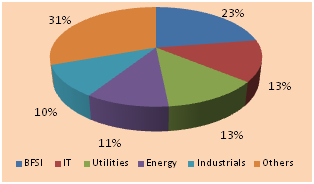

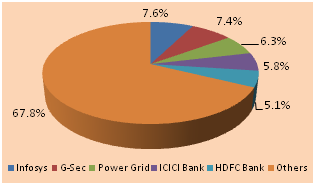

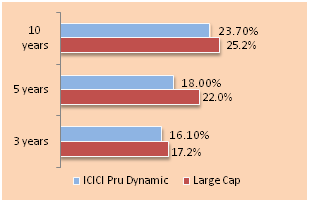

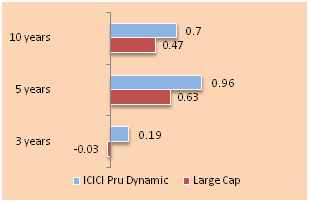

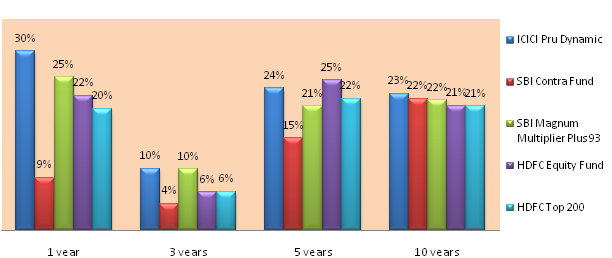

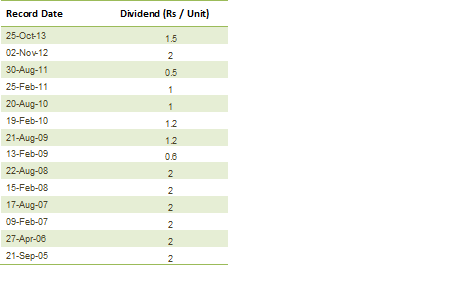

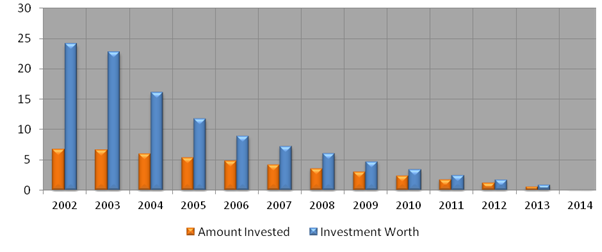

With improving sentiments in Indian and Global equity markets, the Sensex and Nifty have surged to their historical highs in the past few weeks. With improvements in current account deficit and the inflation situation, the macro-economic outlook in India is more positive than before. With Lok Sabha elections round the corner, there is the optimism about a stable government and a return to the agenda of economic reforms. While there are certainly good reasons for optimism, we cannot start rejoicing too early. The fiscal deficit situation is still concerning. FII flows may be impacted by the actions of the US Federal Reserve. El Nino effect on monsoon may nudge food inflation up again and impact interest rates. Growth continues to be weak. Finally, a fractured mandate in the upcoming elections will spoil the party mood that the market seems to be in now. In a previous article, "Best investment option in the coming financial year", we had discussed that in an environment like this, where there is both bullishness and some significant concerns regarding the future outlook of the economy, investors should allocate a greater percentage of their investments to large cap oriented diversified equity funds. The ICICI Prudential Dynamic fund is the best diversified equity fund in terms of last 10 years annualized returns. CRISIL ranks this fund as top performer (Rank Number 1). Morningstar has a 5 star rating for this fund. See the chart below, for the comparison of annualized returns over one, three, five and ten year periods, between ICICI Prudential Dynamic Fund (Growth Plan), Large Cap Funds category and the Nifty. Returns are based on Mar 30 NAVs. ICICI Prudential Dynamic Plan – Fund OverviewThe ICICI Prudential Dynamic Plan is suitable for investors looking for high capital appreciation over a long term, with limited downside potential in volatile markets. As such the fund is suitable for long term investment objectives like retirement planning, children's education etc. This scheme, from the ICICI Prudential AMC stable, was launched in October 2002. The fund has an AUM asset size of over Rs 3500 crores, with an expense ratio of 2.04%. As an asset management company ICICI Prudential is recognized as amongst the best performers across several mutual fund categories. The fund manager of this scheme is the ICICI Prudential CIO, Sankaran Naren and Mittul Kalawadia since 2012. Sanakaran is well renowned as one of best fund managers in the country. Sankaran previously managed the fund from 2006 to 2011. The fund has delivered strong consistent returns since its inception. See the chart below for annual returns of the fund for every year since inception, compared with Nifty returns. ICICI Prudential Dynamic Plan has given excellent returns every year since inception, except during the market downturns in 2008 and 2011. The fund managers have an active portfolio management approach, and this enabled them to protect the portfolio from downside risks during the market downturns. The fund has outperformed the Nifty in all the years since inception, except 2007. The minimum annual return was about 16% in 2004. That is why the fund is an excellent investment option both for medium and long time horizons. The scheme is open both for growth and dividend plans. The current NAV (as on Mar 30 2014) is 143.6 for the growth plan and 19.2 for the dividend plan. Portfolio ConstructionThe fund has 85% of the portfolio invested in stocks, 11% in bonds and holds about 4% in cash equivalents. The portfolio has a large cap bias with a value orientation. The fund managers focus on stocks which have significant long term growth potential. From a sector perspective, the fund managers are overweight on the BFSI sector, with substantial exposure also to IT, utilities, energy and industrial sectors. The portfolio has bias for cyclical stocks and sectors, and is therefore poised to do well when the investment cycle revives in India. In terms of company concentration, the portfolio is very well diversified with its top 5 holdings, Infosys, Government of India Bond, Power Grid, ICICI and HDFC Bank for only 32% of the total portfolio value. Risk & ReturnIn terms of risk or volatility measures, the annualized standard deviations of monthly returns of ICICI Prudential Dynamic Plan is lower than the large cap category across three, five and ten year periods are 16% and 20% respectively. While the volatility of the fund is lower than the category average, the annualized returns over the same periods are better than the category, indicative of strong risk adjusted returns performance from this fund. On a risk adjusted return basis, as measured by Sharpe Ratio, the fund has outperformed the large cap funds category. Sharpe ratio is defined as the ratio of excess return (i.e. difference of return of the fund and risk free return from Government securities) and annualized standard deviation of returns. See charts below for comparison of volatilities and Sharpe ratios of the ICICI Prudential Dynamic Plan and the Large Cap Funds Category. Comparison with Peer SetA comparison of annualized returns of ICICI Prudential Dynamic Plan versus its peer set over various time periods shows this fund is considered a chart topper amongst its peers. Not only has the fund given the highest 10 years annualized returns, but it has outperformed most of its peers across various time periods (1 year, 3 years and 5 years). See chart below for comparison of annualized returns over one, three and five year periods. NAVs as on Mar 30 2014. Dividend Payout Track RecordICICI Prudential Dynamic Plan Dividend Option has an excellent dividend payout track record. It is has paid dividends every year since 2005. To its credit the ICICI Prudential Dynamic Plan, Dividend Option, paid dividends even during the severe market downturns in 2008 and 2011. SIP and Lump Sum Returns since inceptionThe chart below shows returns as on Mar 30 2014 (NAV of 143.6) of Rs 5000 monthly SIP in the ICICI Prudential Dynamic Plan Growth Option, for respective years since inception. The SIP date has been assumed to first working day of the month. The amounts are shown in Rs lakhs. The chart above shows that, a monthly SIP of Rs 5000 in the ICICI Prudential Dynamic Plan Growth Option, from the first working day of the month since inception would have grown to over Rs 24 lakhs, while the investor would have invested in just Rs 6.7 lakhs. This implies an internal rate of return of nearly 18%. With the fund portfolio overweight on cyclical stocks, the IRR is bound to increase even further, as and when the economy recovers.If the investor had invested Rs 1 lakh in the NFO, his or her investment would have now grown to nearly Rs 14.4 lakhs. Conclusion The ICICI Dynamic Plan has delivered over 11 years of strong performance and is a favourite in many investor portfolios. The fund from one of India's largest and best Asset Management Companies, has established itself as a top performer with a fantastic track record. ICICI Prudential AMC has recently won the Morningstar Mutual Fund Awards for the Best Fund House - Debt, Best Fund House- Equity and Best Fund House – Multi Asset (see our news item, Morningstar Mutual Fund Awards for Fund Excellence) and ICICI Prudential Dynamic Equity Plan was adjudged the Best Equity Fund. Investors who are looking for medium or long term capital appreciation, with limited downside risks, can consider investing in the scheme through the systematic investment plan (SIP) or lump sum route. The fund has a good dividend payout track record, and as such may appeal to investors who prefer dividends. Investors should consult with their financial advisors, if this scheme is suitable for their financial planning objectives. ----------------------------------------------- Invest Rs 1,50,000 and Save Tax under Section 80C. Get Great Returns by Investing in Best Performing ELSS Mutual Funds Top 10 Tax Saving Mutual Funds to invest in India for 2016Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. Franklin India TaxShield 4. ICICI Prudential Long Term Equity Fund 5. IDFC Tax Advantage (ELSS) Fund 6. Birla Sun Life Tax Relief 96 7. DSP BlackRock Tax Saver Fund 8. Reliance Tax Saver (ELSS) Fund 9. Religare Tax Plan 10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 -----------------------------------------------

|

| Best Car Insurance Companies in India for 2016 Posted: 24 Jan 2016 04:53 AM PST Insuring a car at the time of purchasing ensures the peace of mind that any expenses that may be incurred due to unforeseen circumstances will be taken care of. Should anything happen, your most loved possession can be restored to its original state without you having to spend a penny. Moreover, having a motor insurance policy is a legal obligation as stated in the Indian Motor Act 1988. Also, car experts recommend that you have a comprehensive car insurance policy which covers your vehicle against losses/damages caused by a third party as well as natural/manmade disasters. The market is brimming with several car insurance companies who boast of offering the most premium Value Added Services in comparison to others. In such a scenario, how do you know which one is certainly the best? We have made things easy for you by compiling a list of the top 5 car insurance companies in India by taking into consideration their past performance in terms of claim settlement ratio, payment options, after sale support, and customer care. Take a look.

Considered as the top-notch car insurer in India, ICICI Lombard offers the most comprehensives policies. When considering buying an insurance policy from India's biggest private part broad insurance agency, one should remember ICICI Lombard's 6.44 Mn settled cases and INR 71.34 Bn in Gross Written Premium in the year 2013-14. The insurer provides repayment services against damages caused to your personal vehicle by natural and manmade calamities and by any other car. In addition to accidental damage facility for co-passengers up to a sum of 2 lakhs, ICICI provides benefits like immediate issuance, free of cost servicing across its network of 3300+ garages in different parts of the country, heavy discounts for the members of Automobile Association, etc. You can also leverage the benefit of multiple payment modes and pay premium or buy an insurance policy from the comfort of your home. ICICI also has a care center team assisting the customers 24*7*365 in case of any issues. Doorstep surveyor facility in case an insurance policy breaks is the cherry on the cake from the insurer.

Another big name in the car insurance market, TATA AIG is considered as the second best car insurer in India because of its policy features like free pick-up of car, online claim and settlement of the same within a week, and several other features. TATA AIG's policies provide cover against total or partial loss in case of mishaps along with any damage to the vehicle's body. Users who hold the Auto secure policy from the insurer can also reap benefits of accidental repairs warranty. Add on covers from TATA AIG include daily allowance, reimbursement of depreciation, return invoice, key replacement, no claim bonus protection. Incepted in the year 2011, TATA AIG also promises to bear the loss of the belongings that may be inside of the car during a mishap. The company lays equal focus on customer satisfaction like its competitors and has a support team for assistance in case you want to make a claim for your policy.

Fig: Showing the market leadership of the insurers in India Source:gibl

Bajaj Allianz not just protects the car owners in India from any unexpected damage to their car but also millions of others overseas. In India, the number 3 ranked insurance company offers free services of garages across 1500 locations. In case the cashless facility is missing, the insurer repays 75% of the amount paid in cash. Other than providing cover against any terrorist activity, Bajaj Allianz offers protection against natural disasters like floods, earthquake, etc., and manmade threats like theft, strike, riot. Primary policy holders of Bajaj Allianz get coverage of Rs 1 lakh in case of accidents. Other than all of the aforementioned benefits, Bajaj policy holders are also on the safer side when it comes to third party legal liability on damages in an accident or lifelong injury or death. In case of breakdown, policy holders get a towing facility and vehicle inspection done by the experts. Any problems or issues are immediately addressed by Bajaj Allianz's customer care team. The company also sends SMS updates to its customers when they are claiming an amount.

Another veteran in the car insurance field, Bharti AXA's full-cycle policies and much applauded customer service puts it at the 4th position. With many benefits like instant road-side assistance in case of breakdowns, lost key assistance, 100% repayment of the depreciated part at the time of settlement, payment of medical expenses of all the co-passengers, etc., Bharti AXA also allows its policy holders to file a claim online and enjoy heavy discount on premium and e-purchase of cars. The company guarantees 100% repayment of the money in case the car gets stolen or is broken beyond repair. Bharti AXA's customers can get cashless services from garages that fall under its network and repairing costs of rubber, batteries, and bags. In case the customers have an ARAI approved anti-theft device, the company offers additional discounts and benefits.

A government owned insurance company; Oriental Insurance has got a lot of history to back itself. Its private auto protection policy, valuable add-ons, and high claim settlement ratio have garnered popularity all over the country. The insurer has earned several awards with the latest being 'Best Public General Insurance Award' and 'Best Bank Financial Institution Award'. Its strong financial framework is indicated by the coveted iAAA rating provided by ICRA. Efficient customer support and online facility to buy and renew policies are other keys to the insurer's success. To conclude, in case you are planning to buy a new car and would like to forget the worries of paying the expenses in the event of any misfortune or an accident, then you can go for policies from any of the above mentioned car insurance companies as per your budget. Remember, a good insurance policy acts as a great financial support and protects you from various hassles that you may encounter in the course of time. ----------------------------------------------- Invest Rs 1,50,000 and Save Tax under Section 80C. Get Great Returns by Investing in Best Performing ELSS Mutual Funds Top 10 Tax Saving Mutual Funds to invest in India for 2016Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. Franklin India TaxShield 4. ICICI Prudential Long Term Equity Fund 5. IDFC Tax Advantage (ELSS) Fund 6. Birla Sun Life Tax Relief 96 7. DSP BlackRock Tax Saver Fund 8. Reliance Tax Saver (ELSS) Fund 9. Religare Tax Plan 10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 -----------------------------------------------

|

| Invest in ELSS Mutual Funds upto 1.5 Lacs to Save Tax Posted: 24 Jan 2016 04:11 AM PST Invest Rs 1,50,000 and Save Tax under Section 80C. Get Great Returns by Investing in Best Performing ELSS Mutual Funds Top 10 Tax Saving Mutual Funds to invest in India for 2016Best 10 ELSS Mutual Funds in india for 2016

1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. Franklin India TaxShield 4. ICICI Prudential Long Term Equity Fund 5. IDFC Tax Advantage (ELSS) Fund 6. Birla Sun Life Tax Relief 96 7. DSP BlackRock Tax Saver Fund 8. Reliance Tax Saver (ELSS) Fund 9. Religare Tax Plan 10. Birla Sun Life Tax Plan

Invest in Best Performing 2016 Tax Saver Mutual Funds Online For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 ----------------------------------------------- |

| You are subscribed to email updates from Prajna Capital - An Investment Guide. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment