Prajna Capital |

- How to Make use of Indexation Benefit for Debt Funds

- Converting Salary Account to Normal Savings Account

- Fixed Income Funds

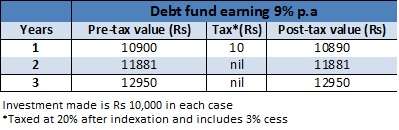

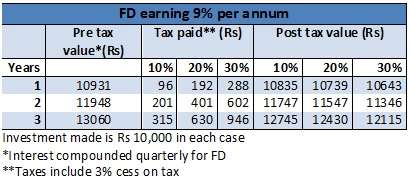

| How to Make use of Indexation Benefit for Debt Funds Posted: 05 Dec 2015 04:42 AM PST Taxation for debt funds changed since this article was published. Please read our blog article on debt fund taxation to update yourself about changes from FY-15. With the financial year just ending, your next big task would be to calculate any tax on income other than your salary. If you are sitting down to calculate your gains on debt funds that you had held for more than a year and sold in the just ended financial year, do consider the capital gains index or cost inflation index . Long-term capital gains Long-term capital gains (held over a year) on debt funds suffer a 10% tax without indexation or 20% with indexation benefit. In the case of the latter, by indexing, you bring your cost of investment to the current value, after factoring general price rise for consumers. Given that the capital gains index has been expanding at a good pace (see table below), courtesy inflation, using the index will likely ensure that you pay very little tax or nil tax on your gains.

Let us take an example of a debt fund, say an income fund, that you bought for Rs 10,000 in 2011-12. If the fund returned 9% and you sell it for Rs 10,900, your long-term capital gain would normally be Rs 900. A 10% tax on this plus cess would be Rs 93.

But if you index the cost of the same with the CII for Hence, make a quick calculation of your gains post indexation before you pay your tax in the next few months. Comparison with FD

Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1.ICICI Prudential Tax Plan 2.Reliance Tax Saver (ELSS) Fund 3.HDFC TaxSaver 4.DSP BlackRock Tax Saver Fund 5.Religare Tax Plan 6.Franklin India TaxShield 7.Canara Robeco Equity Tax Saver 8.IDFC Tax Advantage (ELSS) Fund 9.Axis Tax Saver Fund 10.BNP Paribas Long Term Equity Fund

You can invest Rs 1,50,000 and Save Tax under Section 80C by investing in Mutual Funds

Invest in Tax Saver Mutual Funds Online - For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 --------------------------------------------- Invest Mutual Funds Online Download Mutual Fund Application Forms from all AMCs | |

| Converting Salary Account to Normal Savings Account Posted: 05 Dec 2015 02:54 AM PST Salary accounts are opened by employers to credit the salary of their employees. Usually, these accounts are active in the same bank where company conducts its banking transactions. Savings accounts, on the other hand, are opened by individuals with the bank of their choice. Some positives of a salary account are: 1.Zero balance requirement 2.Free drafts 3.Free pay orders 4.Zero annual or issuance charges for debit cards However, as the agreement of salary account is between the employer and the bank, the extra benefits that come with this account cease to exist after you switch your job. Usually, banks convert the salary account into a savings account if the salary credit does not take place for three consecutive months. We present some points that you need to watch out for, in case you decide to convert your old salary account into a savings account. 1. Salary account relationship in the new job: When converting your old salary account into a savings account, check whether your new employer has a salary account agreement with the same bank as your previous employer. If it is the same bank, you can continue with the old salary account instead of converting it into a savings account. 2. Need for additional savings account: If the salary account with the new employer is with a different bank, then think whether you need an additional savings account. If your old salary account was the first account you ever had, I suggest you continue with that account as a regular savings account. While the salary account with your new employer can always perform the function of a savings account, keep an additional savings account where you can receive payments or credits from other sources. You should ideally use the savings account for making payments for systematic investment plan (SIP), loan EMIs or unit linked insurance plans (ULIPs). 3. Minimum balance requirements: Now that you are opting for an additional savings account, look at the minimum balance requirements that you will have to maintain when converting your salary account. For examples, ICICI Bank and Axis Bank have minimum balance requirements of Rs. 10,000 for a regular savings account in metro and urban locations whereas Standard Chartered requires Rs 25,000 for its regular savings account. As the penalties for non-maintenance of minimum balance can be quite high, you should carefully consider the minimum balance requirements before you convert your salary account into a savings account. 4. Branch locations: Although most of the banking transactions can also be made through internet and mobile banking, there are many services that can only be availed at bank premises. This is where the importance of the location of the branch comes into play. For your own convenience, the bank branch should be ideally located either near your office or your residence. 5. Branch and ATM density: You should only convert your old salary account into a savings account if that bank has a good branch and ATM network, especially in places you frequent. This can save you from the headache of carrying cash with you. Also, if an urgent need arises, you can easily go to a branch or an ATM. ICICI Bank, HDFC Bank, SBI and PNB have good pan-India branch and ATM networks. 6.Change in communication address: Many a times, your communication address in your salary account would be that of your workplace. The communication address is the one where the bank w ould send you the physical monthly statements, cheque books, debit card pins, new debit card or internet banking pins. Therefore, do remember to change your communication address once you leave your present employer. Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. IDFC Tax Advantage (ELSS) Fund 4. ICICI Prudential Long Term Equity Fund 5. Religare Tax Plan 6. Franklin India TaxShield 7. DSP BlackRock Tax Saver Fund 8. Birla Sun Life Tax Relief 96 9. Reliance Tax Saver (ELSS) Fund 10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 | |

| Posted: 05 Dec 2015 01:27 AM PST

Mutual funds' financial manoeuvring, popularly known as "river crossing" in industry parlance, may be a thing of the past as the market regulator has started looking into daily trade data, including those on certificates of deposit, of fund houses. River crossing, or parking or holding period return, is a rampant practice that takes place mostly at the financial year end when mutual funds connect with cash-rich entities to tide over redemption pressure. Regulators normally consider the practice imprudent since it raises investor risk. The Securities and Exchange Board of India (Sebi) is now taking all trade data from MFs, including on CDs and interscheme transactions. There are some outlier trades in the first week of October, which raise suspicion, three people familiar with the matter told ET. This time the redemption pressure was somewhat higher in the middle of the year, triggered by the Amtek Auto fiasco. In September, CD rates spiked about 25 basis points across maturities as banks aggressively raised money to shore up deposits ahead of quarterly earnings. But the rates slid after RBI's rate cut exceeded estimates. At the same time, mutual funds, the biggest buyers of CDs, faced redemption pressure in liquid and ultra short-term funds as lenders wanted to avoid setting aside any extra capital for mutual fund exposure to maintain a good capital adequacy ratio. Intermediaries or brokers connected with a few cash-rich entities -corporates or bankers -which extended funding support to MFs by temporarily buying CDs at higher rate than normal. Beginning next quarter (October), the financial entities will sell back CDs to MFs at a predetermined price, that could give the financing institute gains of 10-20% in annualised return for 5-10 days. For instance, state-owned Syndicate Bank's CD maturing mid-December traded at a high of 7.61% against a normal rate of 7.05% on October 1, said two market sources. On October 5, Andhra Bank and Axis Bank CDs yielded 7.63% each, with both maturing in November-end. It is unwise for mutual funds to participate in this practice," said Dhirendra Kumar, CEO of mutual fund portal Value Research. "The gains are few and if something goes wrong, the potential damage to reputation is immense. Showing higher assets for a few days can hardly be a big achievement Best Tax Saver Mutual Funds or ELSS Mutual Funds for 2015

1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. IDFC Tax Advantage (ELSS) Fund 4. ICICI Prudential Long Term Equity Fund 5. Religare Tax Plan 6. Franklin India TaxShield 7. DSP BlackRock Tax Saver Fund 8. Birla Sun Life Tax Relief 96 9. Reliance Tax Saver (ELSS) Fund 10. HDFC TaxSaver

Invest Rs 1,50,000 and Save Tax under Section 80C. Get Good Returns by Investing in ELSS Mutual Funds Online

Invest in Tax Saver Mutual Funds Online For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 |

| You are subscribed to email updates from Prajna Capital - An Investment Guide. To stop receiving these emails, you may unsubscribe now. | Email delivery powered by Google |

| Google Inc., 1600 Amphitheatre Parkway, Mountain View, CA 94043, United States | |

No comments:

Post a Comment