Documents Required for Investing in Mutual Funds How can one invest in a mutual fund? (Fresh Purchase) |

| After deciding on the type of scheme, the investor will have to fill in the Application form, attach a payment instrument and submit it at any of the funds' official points of acceptance centers before the cut off time. . |

| |

| The investor has to invest in rupees and units will be allotted to him in fractions depending upon the NAV. |

| |

| For example, if the sale price of Birla Advantage Fund was Rs. 23.49 on December 14, 2001, if the investor decides to invest Rs. 25,000 (a round sum) on December 14, 2001, given the price, he will be allotted 1064.2826 units (25,000/23.49). This calculation assumes that there is no sales load applicable to the investor. It is also important to know that the applicable NAV is known only at the end of the day and not at the time the investor hands in the application. |

| |

For investments equal to and exceeding Rs 50,000, providing the Permanent Account Number (PAN) for all the unit holders is mandatory. Additionally, a copy of the PAN card should also be submitted along with the application form for verification. Investors have also to comply with the Know Your Client (KYC) procedure for such investment amounts. |

| What is the procedure to BUY ADDITIONAL units? (Additional Purchase) |

Buying more units either of the same scheme or of a different scheme under the SAME FOLIO is an additional purchase, which can be done through Additional Purchase slips provided along with the account statement. After filling the same, the investor will have to attach a cheque with it and submit it at any of the official points of acceptance centers before the cut-off time. |

| What is the procedure to SWITCH units? |

A switch request will have to be filled in and submitted at any of the official points of acceptance centers before the cut off time. SWITCH can be done with either partial or all units under a particular scheme to another scheme as specified by him under the same folio. |

| What is the procedure to REDEEM / REPURCHASE units? |

| If the fund is open ended, the investor has to send the repurchase requisition slip, duly completed and signed, to any of the official points of acceptance centres. It is possible to lodge repurchase requests on the Internet also. The redemption can be done for all units, partial units, or for an amount. |

| |

Redemption proceeds can be either be directly credited to the investors account OR cheques are issued with the investors bank details printed on them mandatorily. This is to prevent fraudulent encashment of repurchase cheques. |

| Can I take loan against my units in Mutual Fund? What is a Lien? |

| Yes. Investors can take loan against units. Banks treat Units as collateral security. |

| |

Units of a scheme may be offered as security by way of a pledge / charge in favor of scheduled banks, financial institutions, non banking financial companies (NBFCs) or any other body. The AMC will note and record such Pledged Units. Disbursement of such loans will be entirely at the discretion of the bank / financial institution / NBFC and the Mutual Fund assumes no responsibility thereof.. |

| REQUIREMENTS for LIEN Marking: |

| Letter from investor and Pledgee clearly stating - Folio / Sub-account number, Scheme / Plan, Number of Units to be pledged, any other terms. |

| |

| Additional Information : |

| |

- Lien marking requests need to necessarily specify number of units to be pledged. The reason for specifying this is the possibility of erosion in value of investment consequent to market action.

- Lien marking may be for partial number of units held - request for lien marking NEED NOT necessarily be for all units.

- In case of lien-marking of PARTIAL units, investor is free to transact (redeem / shift) on "free units"

- Investor will not be permitted to transact on units that are lien marked unless and until instructions to un-mark lien is given by the Pledgee.

- While units are lien marked, in case investments are under Dividend option, in case of corporate action, dividend will be paid to investor unless specifically instructed by pledgee in instructions to pledge units.

|

| Once the units are LIEN marked the units become the property of the bank until such time that the lien is invoked. The investor cannot redeem these units unless the bank confirms to do so. Once the loan is repaid by the investor, the units will become free from lien. |

| |

| For unmarking of lien, written request from the bank is mandatory. The possible scenarios under which the unmarking of lien request can be received |

| |

- Pledgee has requested for unmarking of lien with / without redemption of units (full / partial) in favour of pledge

- Pledgee has requested for unmarking of lien with the concurrence to redeem the units (full / partial) in favour of investor (as per investor's redemption request).

|

| (see documents required under Documents section) |

| |

| Transmission |

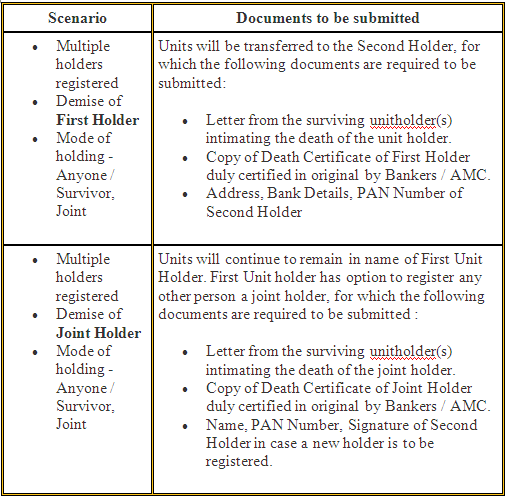

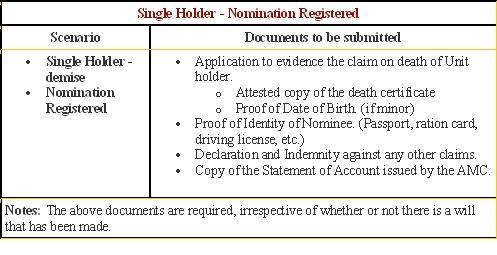

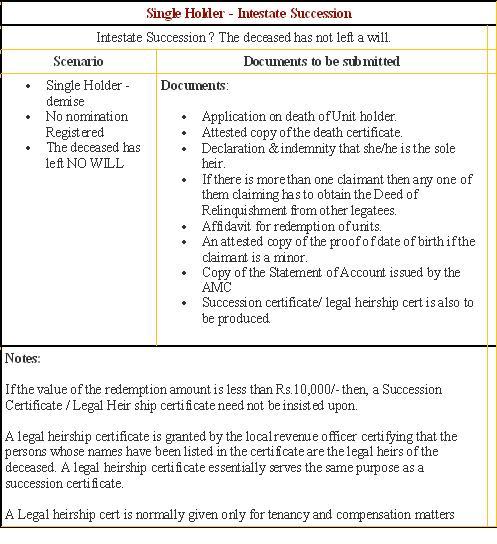

| Mode of Holding | Scenario | | Anyone/Survivor | In case of death of ALL holders, documents would be same as under SINGLE holding. | | Joint | In case of death of ALL holders, documents would be same as under SINGLE holding. | | Single | - Nomination Registered

- Without Nomination

a. Testamentary(Presence of Will)

b. Intestate(Absence of Will) | |

Anyone/survivor or Joint |

| The Units shall stand transferred to the survivor in case of death of any of the joint holders |

| If the mode of holding is Joint |

| If the first holder expires, in a joint holding, the next named holder shall hold the units as the agent and trustee for the legal heirs of the first holder, and in case of the death of the second joint holder, the units shall be transferred to the next named holder, who shall hold the units as the agent for the legal heirs. In case of death of all the joint holders, the units shall be transferred to the nominee. |

| |

| If the first holder expires, in a joint holding, the next named holder shall hold the units as the agent and trustee for the legal heirs of the first holder, and in case of the death of the second joint holder, the units shall be transferred to the next named holder, who shall hold the units as the agent for the legal heirs. In case of death of all the joint holders, the units shall be transferred to the nominee. |

| If the mode of holding is either Anyone/Survivor |

| The Units shall stand transferred to the survivor in case of death of any of the joint holders |

| If the mode of holding is Joint |

| If the first holder expires, in a joint holding, the next named holder shall hold the units as the agent and trustee for the legal heirs of the first holder, and in case of the death of the second joint holder, the units shall be transferred to the next named holder, who shall hold the units as the agent for the legal heirs. In case of death of all the joint holders, the units shall be transferred to the nominee. |

| |

The joint unit holders may together nominate a person in whom all the rights in the units shall vest in the event of death of all the joint unit holders. |

|

|

|

|

Power of Attorney (POA) |

| Power of Attorney, is a legal document whereby a person delegates various authority to a Power of Attorney holder. |

| |

| Power of Attorney registration requests may be received from |

- Individual investors

- Non Individual Investors

- Online Clients

|

| Requirements of a valid power of attorney document |

- POA submitted should clearly contain clause for investment relating powers

- POA submitted should be signed by both - investor and the contituent Power of Attorney

- POA copy should be notarised in original or attested by a bank

- In case of non-individual investors, the relevant extract of a Resolution authorising signatories to execute the Power of Attorney is required be submitted along with the POA.

|

A Power of Attorney document will be registered by Registrar & Transfer Agent, subject to above validations, and a confirmation letter issued to investor. Thereafter, the Power of Attorney holder is permitted to transact on behalf of the investor. |

| Nomination |

| Definition : "Nomination" is an option to nominate a successor to receive the units upon the demise of the first holder in case mode of holding is "single", or upon the demise of all holders in case investments are held "jointly" |

| |

| In accordance with the provisions of regulation 29A of SEBI (Mutual Funds) Regulations 1996, the AMC provides an option to the unitholders to nominate a person in whom the units shall vest in the event of his death. |

| |

Where the units are held by more than one persons jointly, the joint unit holders may together, nominate a person in whom all the rights in the units shall vest in the event of the death of all the joint unitholders. |

| Additional Information: |

- Nominations can be made only by individuals applying for / holding units on their own behalf, singly or jointly.

- Non-individuals including Society / trust / Body Corporate / Partnership Firm / Karta of Hindu Undivided Family / holder of Power of Attorney, cannot nominate.

- Persons applying on behalf of minor / HUF/ Association of persons / Body of individuals / Power of Attorney holders cannot nominate.

- One nominee per folio is permitted.

- In case nominee is a minor, name and address of guardian to be provided

- The nominee shall not be a trust, society, body corporate, partnership firm, Karta of HUF or a Power of Attorney holder.

- Resident holders can nominate a NRI on a non-repatriable basis only

- Nomination in respect of the units stands rescinded upon the transfer of units.Transfer of units in favor of a nominee shall be valid discharge by the AMC against the legal heir.

- The cancellation of nomination can be made only by those individuals who hold units in their own behalf singly or jointly, and who made the original nomination.

- On cancellation of the nomination, the nomination shall stand rescinded and the AMC shall not be under any obligation to transfer the units in favor of the nominee.

|

| Demand Draft Charges |

Investors residing at locations where the Fund does not have an official point of acceptance can make payment by demand drafts payable at locations where the application is to be lodged. The maximum charges so borne, would be restricted to the limits as prescribed by State Bank of India (SBI). |

| The present DD Charges of SBI are as under: |

| For Value : DD charges. |

| upto Rs 10000/- Rs30/- |

| For > Rs 10000/- Rs 3.50/- per Rs 1000/- Min Rs 50/- Max Rs 12500/-. |

| These charges are subject to change. |

No comments:

Post a Comment