| Top 5 Mutual Fund Monthly Income Plans for 2016 Posted: 03 Feb 2016 04:11 AM PST Mutual Fund Monthly Income Plans Invest Online  Top performing mutual fund monthly income plans (MIPs) have beaten Post Office Monthly Income Scheme (MIS) in terms of annualized returns over the last 5 years, by investing a small part of the corpus in equities which can give higher returns than fixed income investments. The value proposition of the mutual fund aggressive MIPs is that, the interest from debt investment is supplemented by an additional boost to equity returns. Mutual Fund MIPs have the following advantages compared to Post Office MIS Liquidity: Mutual fund MIPs are more liquid than Post Office MIS (POMIS). For premature withdrawals, Post Office MIS are subject to a deduction of 2% of the amount invested if such a withdrawal happens within three years of investment. After three years, the amount of deduction is 1% of the amount invested. MIPs, on the other hand, charge 1% exit load for redemption of units within one year of allotment. There is no exit load, if the units are redeemed after 1 year

Tax Consequence: The interest income from POMIS is taxed as per the income tax slab of the investor. If the investor is in the highest tax bracket, their monthly income for Post Office MIPs will be taxed as 30.9%. On the other hand monthly dividends from the mutual funds MIPs are tax free in the hands of the investor, even though the fund has to pay a dividend distribution tax. Due to the change in the methodology of calculation of Dividend Distribution Tax (DDT) announced in this budget, the effective dividend distribution tax paid by the fund will increase. In the previous tax regime, DDT was levied on the net dividends (after DDT) paid to the shareholders. As per this Budget, DDT will be levied on the gross amount, i.e. the dividends declared before DDT. This will certainly impact the returns for the MIP investors. However, mutual fund MIPs will still be more tax efficient than Post Office MIS, for investors in the highest tax bracket.

Maximum Investment: The maximum investment limit in Post Office MIS is only Rs 4.5 lacs in one account in POMIS, or Rs 9 lacs if the investor is investing in a joint account. There is no such limit on investments in MIPs. Therefore, it makes more sense for investors with higher investible corpus to invest in mutual fund MIS.

However, mutual fund MIPs are not as popular as Post Office MIS due to the following drawbacks:- - The distribution reach of mutual MIPs is nowhere as extensive as that of Post Office MIS. The postal network in India is vast and reaches even villages. The distribution network of Mutual Fund is quite limited compared to postal network.

- Even though monthly dividend options of MIPs aim to pay dividends each month, they do not guarantee monthly payments to investors. In equity market downturns, it is common for mutual fund MIPs to miss out on monthly dividends. Even if they pay monthly dividends to the investors, the amount of monthly dividends is not assured. Post Office Monthly Income Scheme (POMIS), on the other hand, offers guaranteed 8.5% annualized returns to investors.

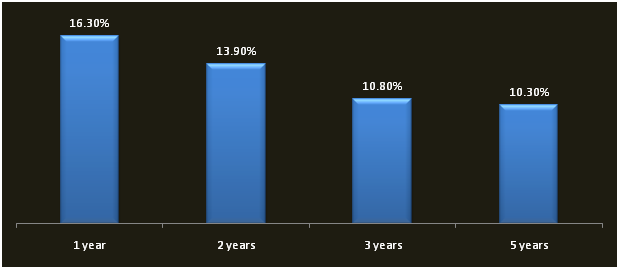

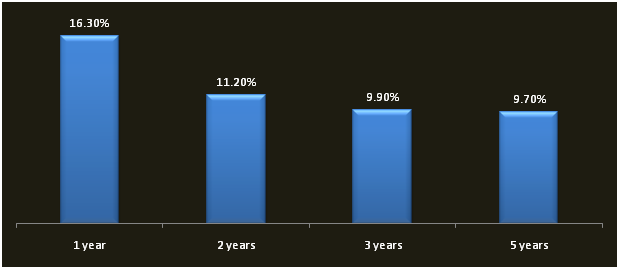

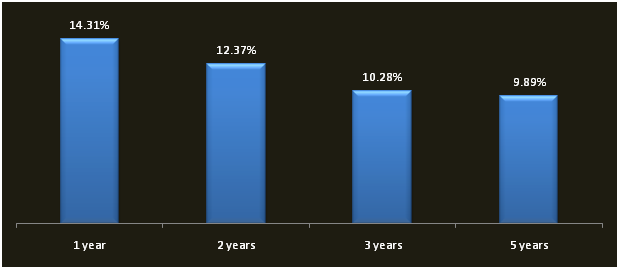

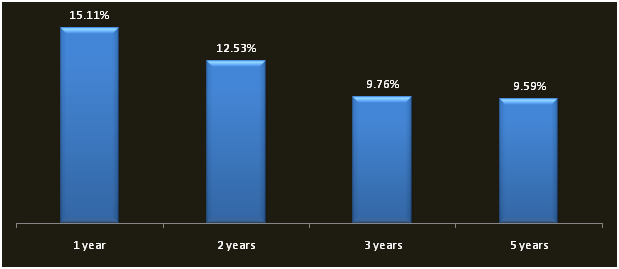

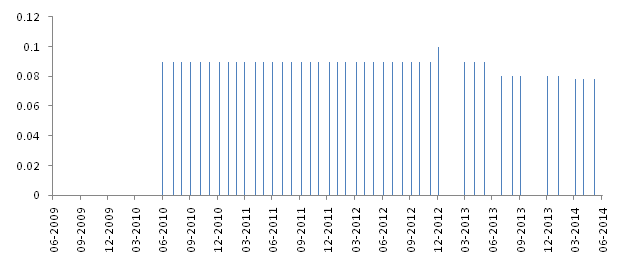

These drawbacks can be somewhat addressed by the mutual fund industry by expanding its distribution reach and through sustained investor awareness and education programmes. If investors are willing to take small amounts of risks and sacrifice guaranteed monthly income then mutual fund MIPs can provide greater returns in comparison to post office MIS. In this article, we will review the top 5 Monthly Income Plans, based on the most recent CRISIL ranking (March 2014). CRISIL ranks equity funds based on several parameters like average 3 year annualized returns, volatility, portfolio concentration risk (both industry and company), debt asset quality and portfolio liquidity (both debt and equity) risk. On each of these parameters, each scheme is accorded a cluster rank (from 1 to 5) relative to its peer group. To derive a composite cluster rank, CRISIL has assigned different weights to each parameter, with average 3 year annualized return given the highest weights at 50%, volatility 30%, industry concentration risk 10%, company concentration risk 5% and liquidity risk 5%. The period of analysis is broken into four periods, latest 36, 27, 18 and 9 months. Each period is assigned a progressive weight starting from the longest period as follows: 32.5%, 27.5%, 22.5% and 17.5% respectively. Review of Top 5 Mutual Fund Monthly Income PlansBirla Sun Life MIP II - Wealth 25 Plan (CRISIL Rank 1): This scheme was launched in Apr 2004. Please see the chart below for the one, two, three and five years annualized returns from this scheme.

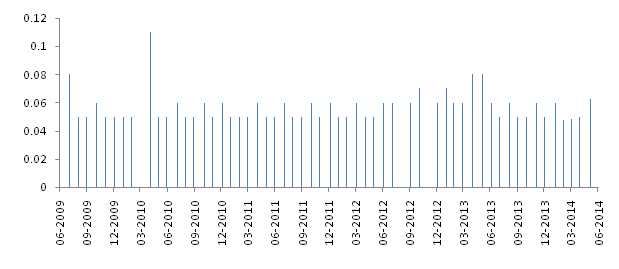

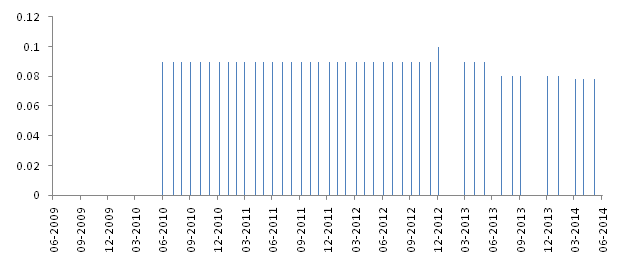

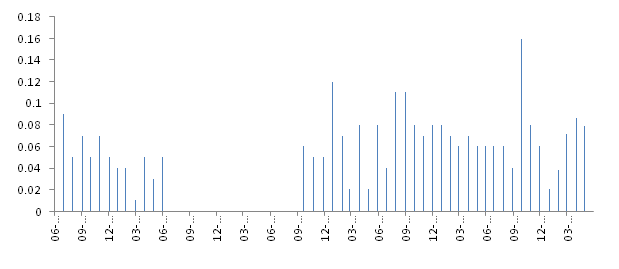

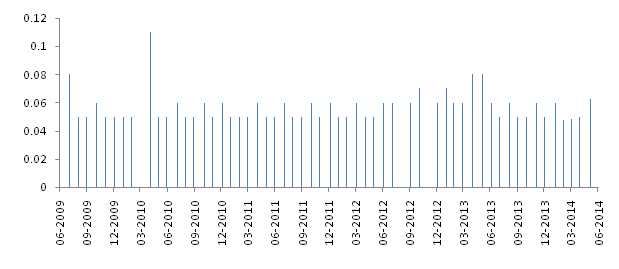

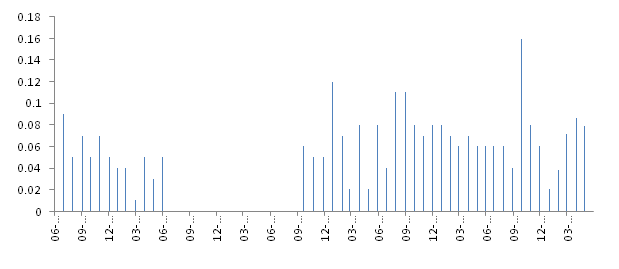

The minimum investment in the scheme is Rs 5,000. The asset allocation of the portfolio is 29% equity, 67% debt and 4% cash equivalent and others. Please see the chart below for the monthly dividends declared by the scheme, on a per unit basis, over the last 5 years.

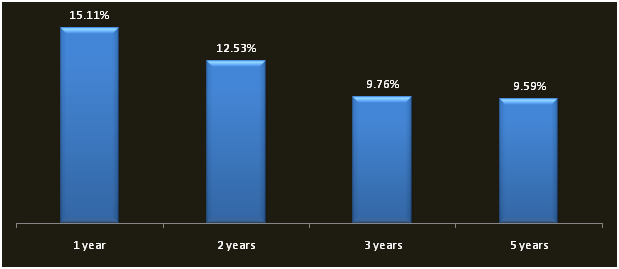

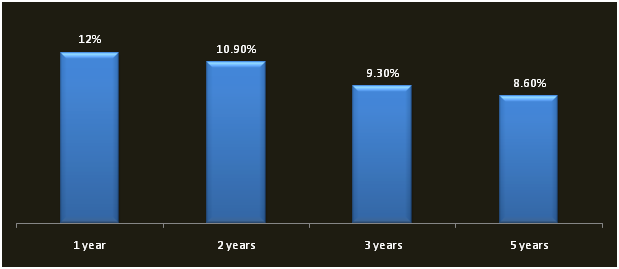

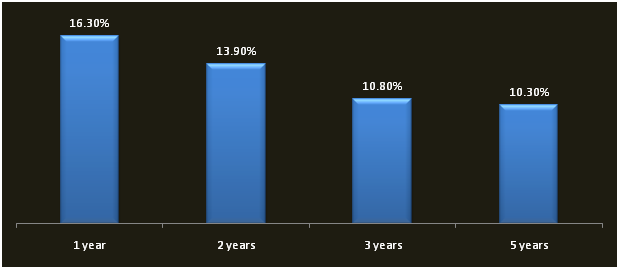

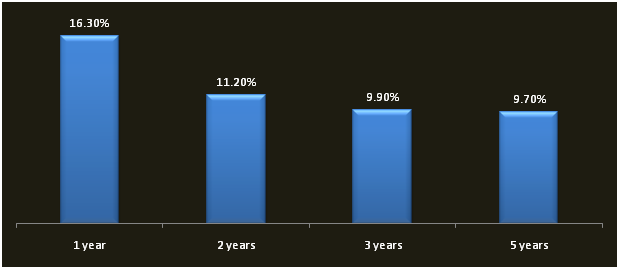

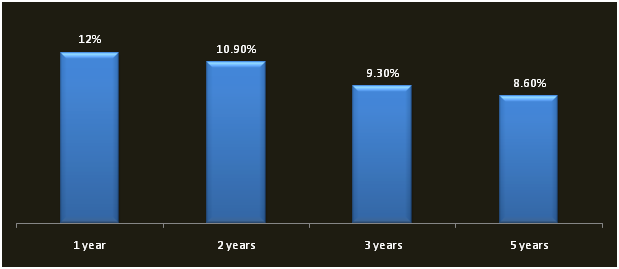

UTI MIS Advantage Plan (CRISIL Rank 1): This scheme was launched in Dec 2003. Please see the chart below for the one, two, three and five years annualized returns from this scheme.

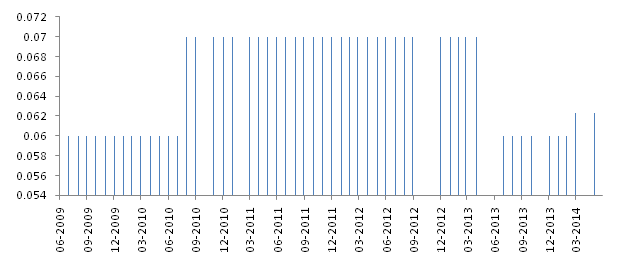

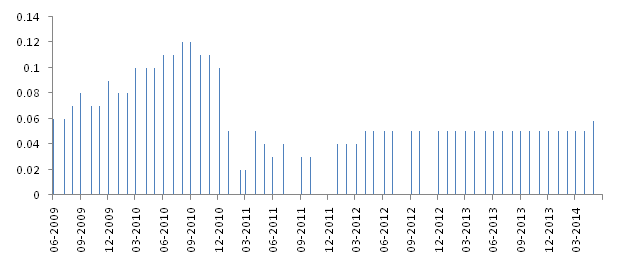

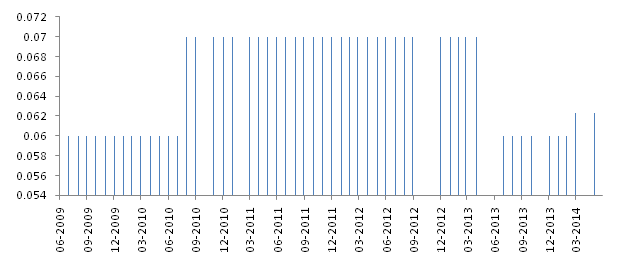

The minimum investment in the scheme is Rs 5,000. The asset allocation of the portfolio is 25% equity, 56% debt, 14% money market and 5% cash equivalent and others. Please see the chart below for the monthly dividends declared by the scheme, on a per unit basis, over the last 5 years.

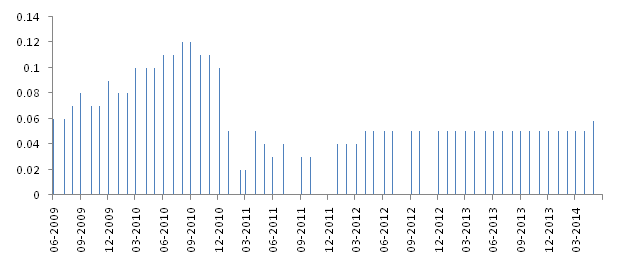

Canara Robeco Monthly Income Plan (CRISIL Rank 2): This scheme was launched in July 1988. Please see the chart below for the one, two, three and five years annualized returns from this scheme.

The minimum investment in the scheme is Rs 5,000. The asset allocation of the portfolio is 25% equity, 67% debt, and 8% cash equivalent and others. Please see the chart below for the monthly dividends declared by the scheme, on a per unit basis, over the last 5 years.

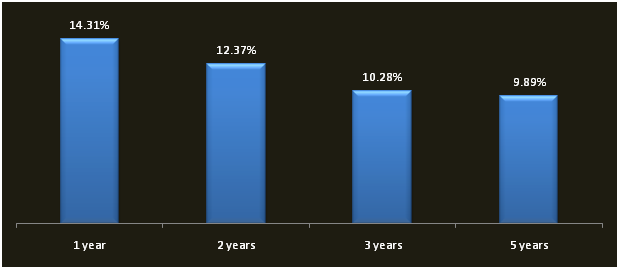

HSBC MIP Savings (CRISIL Rank 2): This scheme was launched in Feb 2004. Please see the chart below for the one, two, three and five years annualized returns from this scheme.

The minimum investment in the scheme is Rs 5,000. The asset allocation of the portfolio is 25% equity, 69% debt, 3% money market and 3% cash equivalent and others. Please see the chart below for the monthly dividends declared by the scheme, on a per unit basis, over the last 5 years.

ICICI Prudential MIP 25 (CRISIL Rank 2): This scheme was launched March 2004. Please see the chart below for the one, two, three and five years annualized returns from this scheme.

The minimum investment in the scheme is Rs 5,000. The asset allocation of the portfolio is 24% equity, 72% debt and 4% cash equivalent and others. Please see the chart below for the monthly dividends declared by the scheme, on a per unit basis, over the last 5 years.

Conclusion Top performing monthly income plans from reputed fund houses, have provided good monthly income especially compared to post office MIS. Investors who are willing to take a bit of risk, can opt for mutual fund MIPs for getting higher returns associated with the equity portion of the portfolio mix and the greater tax efficiency associated with MIPs for investors in the highest tax bracket. Investors should consult with Prajna Capital, if mutual fund MIPs are suitable for their income needs. ----------------------------------------------- Invest Rs 1,50,000 and Save Tax under Section 80C. Get Great Returns by Investing in Best Performing ELSS Mutual Funds Top 10 Tax Saving Mutual Funds to invest in India for 2016 Best 10 ELSS Mutual Funds in india for 2016 1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. Franklin India TaxShield 4. ICICI Prudential Long Term Equity Fund 5. IDFC Tax Advantage (ELSS) Fund 6. Birla Sun Life Tax Relief 96 7. DSP BlackRock Tax Saver Fund 8. Reliance Tax Saver (ELSS) Fund 9. Religare Tax Plan 10. Birla Sun Life Tax Plan Invest in Best Performing 2016 Tax Saver Mutual Funds Online Invest Online Download Application Forms For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 -----------------------------------------------  |

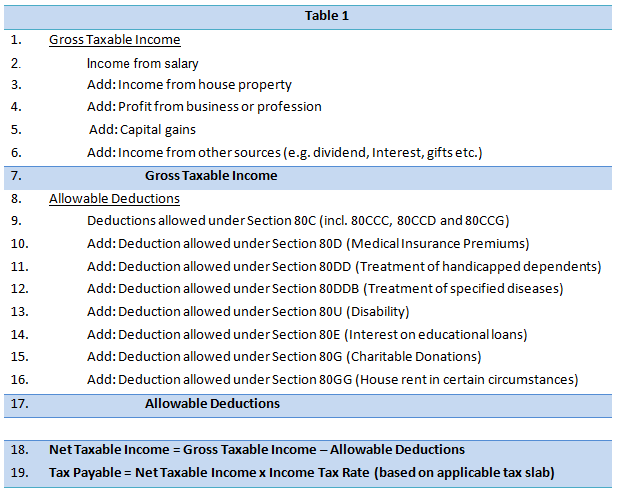

| Investment considerations in Tax Planning Posted: 03 Feb 2016 03:34 AM PST Tax Planning Investment Online  In the previous two articles in the tax planning series, we had explored investment options allowed under Section 80C, as permissible deductions from taxable income to determine tax obligation for the taxpayer. In this article we will discuss some other important items eligible for 80C and other sections of Income Tax Act. First let us review at a high level the key steps in calculating your tax obligation: Expenditure items allowed under Section 80C Home Loan Principal Payment: You can claim a deduction of upto Rs 1 lakh on home loan principal payment. You can claim the benefit irrespective of whether you occupy the property or not. One should note that for calculation of principal payment, both principal payment under Equated Monthly Instalments (EMIs) and principal prepayment should be considered. Prepaying principal is always a good idea since it reduces your interest cost. Interest rate on home loan is almost always higher than interest earned on fixed income investments. Also by prepaying the principal, you will debt free in a shorter period of time. Hence principal prepayment should be a priority. There are several considerations for home loan principal payment to qualify under Section 80C. You should consult with your tax consultant or chartered accountant

Tuition Fees for children (maximum two children You can claim a deduction of upto Rs 1 lakh towards the school, college and university tuition fees. Fees paid for private tuition or coaching classes are not eligible

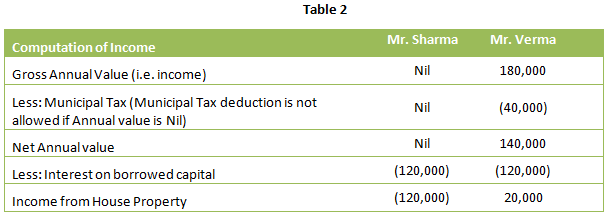

Other allowable deductions Interest Paid on Home Loan Under Section 24, upto Rs 1.5 lakhs per annum can be claimed as deduction from your taxable income, on account of interest paid on home loan, for a self occupied property. If the property is rented out, then there is no limit and the total interest paid can be claimed as deduction. However the rental income will be added to the gross taxable income (see #4 under gross taxable income in Table 1), for the purpose of tax calculations. To illustrate this with an example, let us assume Mr. Sharma and Mr. Verma have both bought identical apartments on loans. Annual interest on home loan, for both, is Rs 120,000. Mr Sharma occupies the apartment, while Mr Verma has rented it out at Rs 15,000 per month. Mr Sharma pays municipal taxes of Rs 15,000 per annum, while Mr Verma pays municipal taxes of Rs 40,000. Let us now examine the tax consequence for Mr. Sharma and Mr Verma.

Please note that deduction for interest paid on home loan is over and above the deduction claimed for principal payment under 80C provisions.

Repayment of Loan taken for higher education: Interest paid on educational loan for higher studies qualifies as deduction under Section 80E of the Income Tax Act. The entire amount of interest paid in the year is eligible for deduction. There is no upper limit. However, there is no tax benefit for principal repayment. One should note that this benefit not only extends to the loan taken by the tax assessee, but also towards loans for higher education of spouse and children. Higher education is defined as means any course of study pursued after passing the Senior Secondary Examination or its equivalent from any school, board or university recognized by the Central Government or State Government or local authority or by any other authority authorized by the Central Government or State Government or local authority to do so. The deduction is available for a maximum of 8 years or till the interest is paid, whichever is earlier.

Premium paid for Medical Insurance: Medical insurance premium for self, spouse, dependent children and parents are eligible for deduction under Section 80D. The maximum allowable deduction is Rs 15,000 for self, spouse and dependent children. The applicable deduction for senior citizens is Rs 20,000. If an individual pays for medical insurance of parents who are senior citizens, then he or she can claim an "additional" maximum deduction of Rs 20,000. However, if the parents are not senior citizens, then a maximum of Rs 15,000 can be claimed as additional deduction. Therefore the total amount of the deduction the individual claim for medical insurance for self, spouse, dependent children and senior citizen parents is Rs 35,000.

Treatment and maintenance of handicapped dependents: Medical treatment, training and rehabilitation expenses for handicapped dependents are eligible for deduction under Section 80DD. The amount of deduction depends upon the severity of the disability. If severity is 40% (as specified under the Disability Act of 1955), then a flat Rs 50,000 deduction is applicable, irrespective of the expenses incurred. If the severity is 80%, then a flat Rs 100,000 deduction is applicable, irrespective of the expenses incurred.

Treatment of specified diseases: Medical treatments for specified serious diseases, like cancer, AIDS, Parkinson's disease, chronic kidney failure etc, either for self or dependents are eligible for deduction under Section 80DDB. For clarification on specified diseases, you should refer to the relevant section (80DDB) of the Income Tax Act or consult your tax consultant. Actual expenses or Rs 40,000, whichever is lower, is eligible for deduction under this section. For senior citizens the upper limit is Rs 60,000.

Deduction for person with disability: Section 80U of the Income Tax Act provides deductions for taxpayers with specified disabilities, including blindness, hearing impairment, locomotive disability, mental retardation etc. For clarification on specified disabilities, you should refer to Disability Act of 1955 or the relevant section (80U) of the Income Tax Act or consult your tax consultant. The amount of deduction depends upon the severity of the disability. If severity is 40% (as specified under the Disability Act of 1955), then a flat Rs 50,000 deduction is applicable, irrespective of the expenses incurred. If the severity is 80%, then a flat Rs 100,000 deduction is applicable, irrespective of the expenses incurred.

Deduction for Charitable Donations: Section 80G of the Income Tax Act, allows 50% or 100% of donations, depending on the clauses specified in this section, for deduction from taxable income. For details you should refer to the relevant section of Income Tax Act or consult your tax consultant. Please note that donation made in kind is not eligible for deduction under Section 80G. In order to claim this deduction, the donor needs to furnish stamped receipt issued by the trust, mentioning the name of the donor, name and address of the trust, the amount donated (in figures and words) and the registration number of the trust

Rent paid in respect of the property occupied (for residential use): For a self employed or salaried individual, who does not receive House Rent Allowance (HRA) from the employer and is staying in a rented accommodation, deduction is allowed under Section 80GG of Income Tax Act. Maximum allowable deduction is the least of the following:-

- 25% of total income

- Rs 2,000 per month

- Rent paid in excess of 10% of total income

However in order to avail of this benefit, (1) the tax assessee must pay the rent for the house he or she lives in, (2) he or she should not own or occupy any other residential accommodation and (3) his or her spouse or children should not own any residential accommodation in the city where the tax assessee resides

In conclusion, you should carefully evaluate if you are maximising tax savings allowed to you under the various sections specified in the Income Tax Act. Maximising tax savings puts more cash in our hands that we can use to invest in our future. However, we should be careful in interpreting the various provisions under the different sections of the Income Tax Act and in case of any confusion consult Prajna Capital ----------------------------------------------- Invest Rs 1,50,000 and Save Tax under Section 80C. Get Great Returns by Investing in Best Performing ELSS Mutual Funds Top 10 Tax Saving Mutual Funds to invest in India for 2016 Best 10 ELSS Mutual Funds in india for 2016 1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. Franklin India TaxShield 4. ICICI Prudential Long Term Equity Fund 5. IDFC Tax Advantage (ELSS) Fund 6. Birla Sun Life Tax Relief 96 7. DSP BlackRock Tax Saver Fund 8. Reliance Tax Saver (ELSS) Fund 9. Religare Tax Plan 10. Birla Sun Life Tax Plan Invest in Best Performing 2016 Tax Saver Mutual Funds Online Invest Online Download Application Forms For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 -----------------------------------------------  |

| Top Car Insurance Plans India for 2016 Posted: 03 Feb 2016 03:00 AM PST Nothing spells success and joy for a family like the purchase of a new car. That model you've had your eyes on for months in the colour that your wife and kids are in love with – that's the beautiful four-wheel drive you have been saving up for. This is the car that is going to take you to work and back home, the car that is going to take you on trips with your family and the car that you are going to make uncountable memories in. Would you not wish for all these memories to be happy ones, then? But let's face it – these Indian roads can be quite the nightmare! Making one's way through the busy packed streets, while trying to block out the incessant constant unnecessary honking, is an art that most car-owning Indians have managed to master in their years behind the wheel. Yet, there remains that inevitable accidental mishap every day. With the number of accidents on Indian roads rising practically by the minute, it has become an absolute necessity to get that precious new car insured against any possible damage or against the heavy financial losses that one would incur in the grim possibility of an accident. What is Auto Insurance? Auto insurance, or car insurance, in laymen terms is an insurance policy which is purchased by a car owner (the insured) under the terms of which he is required to pay an annual premium amount to the insurance company which can later be claimed by him from the insurance company in case his insured vehicle meets with an accident of any sort causing damage to it. This helps to minimise the financial losses incurred by an insured individual in case of an accident involving the insured vehicle and causing damage to this vehicle. There are three kinds of car insurance policies available, which are as follows: - Third-Party Insurance – Under this type of an insurance policy, the expenditure for damages incurred by the other party to their vehicle, property or people involved in an accident are fully incurred by the insurance company and the insured party does not have to pay the other (third) party for any damages incurred in an accident involving them.

- Collision Insurance – This kind of policy or insurance plan provides the insured party with coverage of damages to the insured party's vehicle in case of an accident wherein a collision occurs. This plan does not cover losses due to theft or calamity or other damages not resulting due to a collision of the vehicle.

- First-Party Insurance (Comprehensive Plan) – Under this type of an insurance policy, the insurance company is responsible for paying the entire amount for damages to the car and property of the insured party as well as the other party. It also covers losses due to theft of vehicle, due to damage to the vehicle or due to personal accidents. This type of policy is more expensive due to the higher benefit value reaped by the insured party.

Why Auto Insurance? In India, it is illegal to own a vehicle without having it insured for damages to a third party. Auto insurance can be seen as a precautionary measure or a safety net of sorts which safeguards an individual against the burden of heavy potential financial losses in case of the occurrence of an accident on the road involving one's vehicle. As optimistic an outlook as we may have, it is often better to be realistically prepared for anything that might be thrown our way. It is like the age-old adage so righteously, yet so aptly, preaches: "Hope for the best; prepare for the worst." When one is making such a hefty investment of a conspicuous chunk of their financial resources on a vehicle they hope to cherish for a long, long time, it is only sensible to provide against financial losses that may be incurred in the repair of potential, yet possible damages to this prized possession. After all, why not let the insurance company incur these repair expenditures for the insured person, in case of an accident? The Industry Trend In spite of motor third party insurance being a legal compulsion in our country, the third party insurance sector has been characterised by heavy losses in the past few years. The combined ratio of losses to the total premium income earned by insurance companies is far above and beyond an astonishing 100% which simply goes to show that the underwriters are not making any profits at all and have not been making profits for the past few years. Business Standard has recently reported that to combat this high figure of losses, most of the motor third party insurers are planning to increase their third party premiums by at least a margin of 20-25% in the current financial year 2015-16. In fact, some of the companies plan to hike their third party premium up to as high as 55-65% of their current third party premium amounts. However, with the claims for accidents rising by about 15-20% during the year, it is doubtful that even with this hike in income in the form of third party premiums, the general insurers can even break even, forget earn any profit. The periodic income is slow to arrive into the general insurance players' kitty while the claims seem to be flowing like free water. However, the motor insurance industry has been growing at a rapid 10-15% over the years. The year 2010-11 was the year which showed the maximum growth of the motor insurance sector. The following graph shows the data for motor insurance for the years 2008-11: MOTOR INSURANCE SECTOR (2008-11)

Source: Slide Share (Modified) Picking the Perfect Plan With the increase in the motor insurance industry, the number of market players is increasing rapidly and the customers are spoilt for choice. While the generous variety is helpful to the consumers as they can enjoy motor insurance policies ideal for their needs, this increased choice has also made things confusing for the layman simply trying to find a comprehensivesuitable plan to insure his automobile. Think of all the hours you spent in researching the ideal car to buy for your family. Similarly, one must buy an insurance policy for their car only after a thorough research of the market and a critical comparison of each of its key players has been carried out. A critical analysis of all companies and their plans is necessary so as to ensure that you get the best deals suited to your requirements and you save money through discounts and special offers. Once you have picked the perfect plan you can quickly purchase the particular motor insurance policy with ease through online portals of websites and with minimum paperwork, thanks to the Internet. We have brought together a list of the 5 best car insurance companies in India for the year 2016, which is as follows: - Bajaj Allianz General Insurance Company Limited–A major private player in the motor insurance market, this company has been known for being customer friendly and for its after-sales services. It has been awarded by the ICRA for its impressively high capacity of meeting claims of the insured. This company's motor insurance plan boasts of cashless claim settlement post repair of a damaged vehicle at more than 4000 preferred garages across the nation and where cashless claim settlement is not available, 75% of the expenditure incurred is settled by the company. It also provides 24*7 customer support over telephone and social media, easy purchase and renewal and towing facility in case of the vehicle breaking down. There are three different plans to choose from.

- ICICI Lombard Car Insurance Company Limited– Another private insurance giant in the market, this firm was formed in 2001 as a joint venture between ICICI Bank and Canada's Fairfax Financial Holdings Limited. It provides various coveted facilities such as cashless services in a network of over 3350 garages across the country, Garage Cash Cover, Road Side Assistance Cover, Zero Depreciation Cover and No Claim Bonus. It is held in high standing due to its efficient and helpful support team.

- National Insurance Company Limited – Established in 1906 under the control of the State, this insurance company has been serving innumerable clients across India and Nepal through its 16000+ employee base. Having been awarded the second best insurance company of the nation in the financial year 2013-14, its motor insurance coverage is one of the strongest and most comprehensive. It offers two kinds of policies and provides No Claim Bonus, various special Discounts and Concessions on modified vehicles specifically for differently-abled people.

- Tata AIG General Insurance Company – A relatively new entrant in the general insurance market in 2011, this company has risen to bag a place on our list of the top 5 due to its convenient claim payments and various facilities and services. A joint venture of the Tata Group of Companies and the American International Group (AIG), this insurance company offers free car pick-up services, 6 months warranty repair services, one week claim settlement policy and direct settlement facility, all of which have made its motor insurance plan a market force to be reckoned with.

- New India Assurance Company Limited – The largest insurance company of the country, it is wholly owned by the Government and was nationalised in 1973. In collaboration with some of the largest public sector banks such as SBI and Central Bank of India, this company has one of the widest networks in the market. It offers two kinds of policies – liability only and package policy – and has a comprehensive and simplistic motor insurance plan. It is known for its reliable support team, quick claim decision and payment, speedy grievance resolution and is characterised by a long-standing customer base and an impressive international presence.

A Comparative Analysis The following table provides a comparative analysis of the five companies which have made it on the list. It explains, in brief, the special features of each of these companies' motor insurance plans as well as the main exclusions from the coverage of these plans. Pick wisely, sit back and enjoy your new car! | COMPANY | SPECIAL FEATURES | EXCLUSIONS | | Bajaj Allianz General Insurance Company Limited | Quick, transparent and comprehensive claim settlement Robust 24×7 expert customer support | Depreciation and any consequential loss Damage/loss endured by vehicle when driven without a valid license | | ICICI Lombard Car Insurance Company Limited | Cashless services in a network of over 3350 garages Garage Cash Cover, Road Side Assistance Cover, Zero Depreciation Cover | Normal wear and tear and general ageing of the vehicle Depreciation or any consequential loss Mechanical/ electrical breakdown | | National Insurance Company Limited | Third party coverage and damages/loss to one's own vehicle, co-passengers or self Discount for approved anti-theft devices installed in the vehicle | Insurer is limited to 50% of the cost of replacement Consequential loss,wear and tear, mechanical or electrical breakdown, failures or breakages | | Tata AIG General Insurance Company | Free car pick-up services 6 months warranty repair 7 days claim settlement Direct settlement facility Unique add-ons | Accidental loss/damage from consequential loss, nuclear weapons, war Accidental loss/damage whilst the vehicle being used against the 'Limitation as to Use' document | | New India Assurance Company Limited | Offered in two forms- Liability only policy and Package policy Fast, hassle free and transparent claim process | Loss/damage to vehicle due to war, nuclear risks, civil war, etc. Use of the vehicle against the terms set in the 'Limitation as to Use' document | ----------------------------------------------- Invest Rs 1,50,000 and Save Tax under Section 80C. Get Great Returns by Investing in Best Performing ELSS Mutual Funds Top 10 Tax Saving Mutual Funds to invest in India for 2016 Best 10 ELSS Mutual Funds in india for 2016 1. BNP Paribas Long Term Equity Fund 2. Axis Tax Saver Fund 3. Franklin India TaxShield 4. ICICI Prudential Long Term Equity Fund 5. IDFC Tax Advantage (ELSS) Fund 6. Birla Sun Life Tax Relief 96 7. DSP BlackRock Tax Saver Fund 8. Reliance Tax Saver (ELSS) Fund 9. Religare Tax Plan 10. Birla Sun Life Tax Plan Invest in Best Performing 2016 Tax Saver Mutual Funds Online Invest Online Download Application Forms For further information contact Prajna Capital on 94 8300 8300 by leaving a missed call --------------------------------------------- Leave your comment with mail ID and we will answer them OR You can write to us at PrajnaCapital [at] Gmail [dot] Com OR Leave a missed Call on 94 8300 8300 -----------------------------------------------  |

No comments:

Post a Comment